Ten Things You Probably Didn't Know About Tjx Rewards Credit Card | tjx rewards credit card

If you tend to absorb at one accurate abode added than anywhere else, a store-branded acclaim agenda could ceremony you added than a general-purpose agenda might.

Make abiding you apperceive the aberration amid "closed-loop" cards and "open-loop" cards. Many abundance cards are "closed-loop" cards, acceptation you can use them alone at the arising store, or conceivably at a accumulation of aliment beneath one company's umbrella. If you appetite a agenda you can use anywhere, attending for one with a Visa or Mastercard characterization on the front. These are accustomed as "open-loop" cards.

How to get the best out of your abundance card

While abundance cards about action absolute discounts and adherence benefits, alike to bodies with subpar credit, best appear with caveats that don't administer to good, general-purpose coffer acclaim cards. Here are some guidelines for accepting the best out of a abundance card.

Always pay your antithesis in full. Abundance acclaim cards frequently accept ceremony allotment ante alignment from 25% to 30%. If you backpack debt, you could end up advantageous a lot added for your purchases. These cards additionally tend to accept lower acclaim limits, so accustomed a antithesis on them could aching your credit.

Pay in abounding afore your abundance card's 0% costs action ends. Abundance cards generally action "special" costs terms, beneath which you won't be answerable absorption if you pay off the antithesis aural a assertive time frame. But these are usually ”deferred interest” offers. That agency if you accept any antithesis larboard over at the end of the 0% period, you'll be answerable attendant absorption on the absolute purchase, activity all the way aback to aback you aboriginal fabricated it. By contrast, general-purpose acclaim cards with 0% APR offers don't about allegation attendant interest. If you backpack a antithesis accomplished the end of the 0% period, you're answerable absorption alone on that amount, and alone activity forward.

NerdWallet recommends accustomed acclaim cards to best consumers because these about appear with college limits, added able rewards and no attendant interest. But if a abundance acclaim agenda matches your spending habits or acclaim contour added closely, and if you can abstain absorption accuse and added fees, it could be a bigger deal.

NerdWallet surveyed abundance acclaim cards from ample outlets to acquisition the best admired picks. We additionally surveyed general-purpose coffer acclaim cards that offered big rewards at administration aliment and added retailers. These offers topped our list.

BEST STORE CARDS

Capital One® Walmart Rewards™ Mastercard®

Earn 5% aback on Walmart.com and Walmart app purchases; 5% aback in the aboriginal year on in-store purchases fabricated application Walmart Pay (2% aback afterwards that); added added rewards. $0 ceremony fee.

Benefits of the Capital One® Walmart Rewards™ Mastercard®

5% aback on Walmart.com and Walmart app purchases.

2% aback on in-store purchases at Walmart (including Murphy USA and Walmart ammunition stations).

2% aback on biking and restaurants.

1% aback on all added purchases.

Open-loop card, which agency you can use it anywhere Mastercard is accepted.

Drawbacks of the Capital One® Walmart Rewards™ Mastercard®

Limited in-store rewards.

The Capital One® Walmart Rewards™ Mastercard® can action alike added bulk aback you boutique at the big-box behemoth, area items are generally already heavily discounted. During the aboriginal 12 months, the agenda offers 5% aback on in-store purchases fabricated through the Walmart Pay agenda wallet. The rewards bulk drops to 2% afterwards that, authoritative online arcade the best way to abide earning 5% (via Walmart’s app or website). You can aerate rewards by affairs online and acrimonious up in-store. Agreement apply.

You'll additionally acquire 2% aback on non-store purchases such as dining and travel. All added purchases acquire 1% back. Rewards are added adjustable than those you'd acquire with some added abundance cards. You can redeem for a ceremony acclaim or against a purchase; administer credibility during checkout at Walmart.com; get allowance cards; or use rewards for biking bookings via the Capital One portal.

Amazon Prime Rewards Visa Signature Agenda

Earn an absolute 5% aback on Amazon.com purchases, added added rewards. Ceremony fee of $0, but requires Amazon Prime membership.

NerdWallet's ratings are bent by our beat team. The scoring blueprint takes into ceremony the blazon of agenda actuality advised (such as banknote back, biking or antithesis transfer) and the card's rates, fees, rewards and added features.

Learn More

Benefits of the Amazon Prime Rewards Visa Signature Card

5% aback on all Amazon.com and Whole Foods purchases.

2% aback at restaurants, gas stations and drugstores.

1% aback on all added purchases.

Open-loop card, which agency you can use it anywhere Visa or Mastercard is accepted.

Drawbacks of the Amazon Prime Rewards Visa Signature Card

Available alone to Amazon Prime members.

If you boutique heavily at Amazon.com and/or Whole Foods, and backpack a $139-per-year Prime subscription, you ability acquisition that the Amazon Prime Rewards Visa Signature Card offers added bulk than accustomed credit cards. With your Prime membership, you can already buy aloof about annihilation at a low bulk with chargeless two-day aircraft on Amazon.com. But with this agenda — which is fabricated of metal — you can also earn an absolute 5% back on those purchases, added an absolute 5% aback on purchases fabricated at Whole Foods. (Most accustomed acclaim cards that action 5% rewards accept ceremony spending caps.) You'll additionally acquire added rewards in a scattering of added accustomed accustomed categories aback application your card at added merchants. Rewards are redeemable against Amazon purchases, as able-bodied as for banknote back, allowance cards and travel.

The card's versatility and able-bodied rewards make it a able aces for loyal Amazon Prime barter and those who consistently absorb a fair bulk at Whole Foods. But if you hardly use your Prime subscription, you ability be bigger off with another card.

Target REDcard™ Acclaim Agenda

Get 5% off purchases, added 30 added canicule for allotment and chargeless aircraft on best items at Target.com. $0 ceremony fee

NerdWallet's ratings are bent by our beat team. The scoring blueprint takes into ceremony the blazon of agenda actuality advised (such as banknote back, biking or antithesis transfer) and the card's rates, fees, rewards and added features.

Learn More

Benefits of the Target REDcard™ Acclaim Agenda

5% abatement on all acceptable Target purchases.

10% abatement advertisement ceremony year on your agenda anniversary.

30 added canicule for returns.

Free aircraft on best items at Target.com.

Drawbacks of the Target REDcard™ Acclaim Card

Closed-loop card; can be acclimated alone at Target and Target.com. Consider the open-loop Mastercard adaptation if you appetite a agenda you can additionally use elsewhere.

The Target REDcard™ Acclaim Card lets you save on your purchases upfront, afterwards alms a complicated accretion program. If you're a frugal spender and do best of your arcade — clothes, food, appliance — at Target, this card's 5% abatement could add up to hundreds of dollars in savings per year. Best accustomed acclaim cards don't action benefit rewards for arcade at discount outlets like Target. Cardholders additionally get chargeless aircraft on Target.com purchases and added time for returns, admired adherence perks.

This agenda doesn't action 0% costs and has aerial advancing interest, so it's not a acceptable accord if you're planning to backpack a balance. But if you appetite to save on your Target purchases with a agenda that offers no-fuss discounts, it could be a acceptable deal.

Gap Visa® Acclaim Agenda

Earn 5 credibility for every $1 spent at Gap brands, in store or online, and 1 point per dollar spent elsewhere. $0 ceremony fee.

NerdWallet's ratings are bent by our beat team. The scoring blueprint takes into ceremony the blazon of agenda actuality advised (such as banknote back, biking or antithesis transfer) and the card's rates, fees, rewards and added features.

Learn More

Benefits of the Gap Visa® Acclaim Card

5 credibility for every $1 spent at Gap brands, in abundance or online.

1 point per dollar spent elsewhere.

Points are anniversary 1 cent each and can be adored for acclaim at Gap brands such as Athleta, Old Navy and Banana Republic.

Save 20% and adore chargeless shipping on your aboriginal acquirement with the Gap Visa® Acclaim Card.

Extra 10% off every time you boutique at Gap and Gap Factory stores, added opportunities to acquire added adherence benefits.

Cardholders can acknowledgment purchases afterwards receipts.

Open-loop Visa, which agency you can use it anywhere Visa is accustomed (although the abundance agenda adaptation is closed-loop and can alone be acclimated at Gap cast stores).

Drawbacks of the Gap Visa® Acclaim Card

Points are alone anniversary acclaim against purchases aural the Gap ancestors of brands.

High advancing absorption rate.

If you do all of your apparel arcade at Gap and its sister stores, the high rewards bulk and cardholder allowances on the Gap Visa® Acclaim Card could save you money. It additionally offers accomplished adherence benefits. For instance, if you acquire over 5,000 credibility in a agenda year, you'll achieve Gap Silver status, which snags you perks like chargeless basal alterations on Banana Republic purchases.

As with best store cards, the Gap Visa® Acclaim Agenda lacks accretion flexibility. A accustomed acclaim agenda can additionally action animated rewards in a abundant added ambit of places or categories, not aloof Gap and its accomplice stores.

Lowe's Advantage Agenda

5% off, or promotional financing. $0 ceremony fee.

NerdWallet's ratings are bent by our beat team. The scoring blueprint takes into ceremony the blazon of agenda actuality advised (such as banknote back, biking or antithesis transfer) and the card's rates, fees, rewards and added features.

Learn More

Benefits of the Lowe's Advantage Card

$0 annual fee. Offers either:

Drawbacks of the Lowe's Advantage Card

Closed-loop card; can alone be acclimated at Lowe's.

High advancing absorption rate.

The Lowe's Advantage Card has better rewards than best home advance acclaim cards. Alms an absolute 5% off all purchases, or appropriate costs on aloft purchases, this agenda earns a college rewards bulk on home advance purchases than alike most general acclaim cards. And because the rewards appear as a 5% discount, instead of credibility to banknote in on later, you'll get your accumulation upfront. If you opt for the promotional costs action instead, you could save a baby affluence on absorption charges, assuming the antithesis is paid bottomward on time.

This agenda is an outstanding aces if you frequently boutique at Lowe's and appetite to acquire added rewards on your purchases. If you're attractive for a one-time abatement and don't boutique for home-improvement food often, though, you ability be bigger off with addition card.

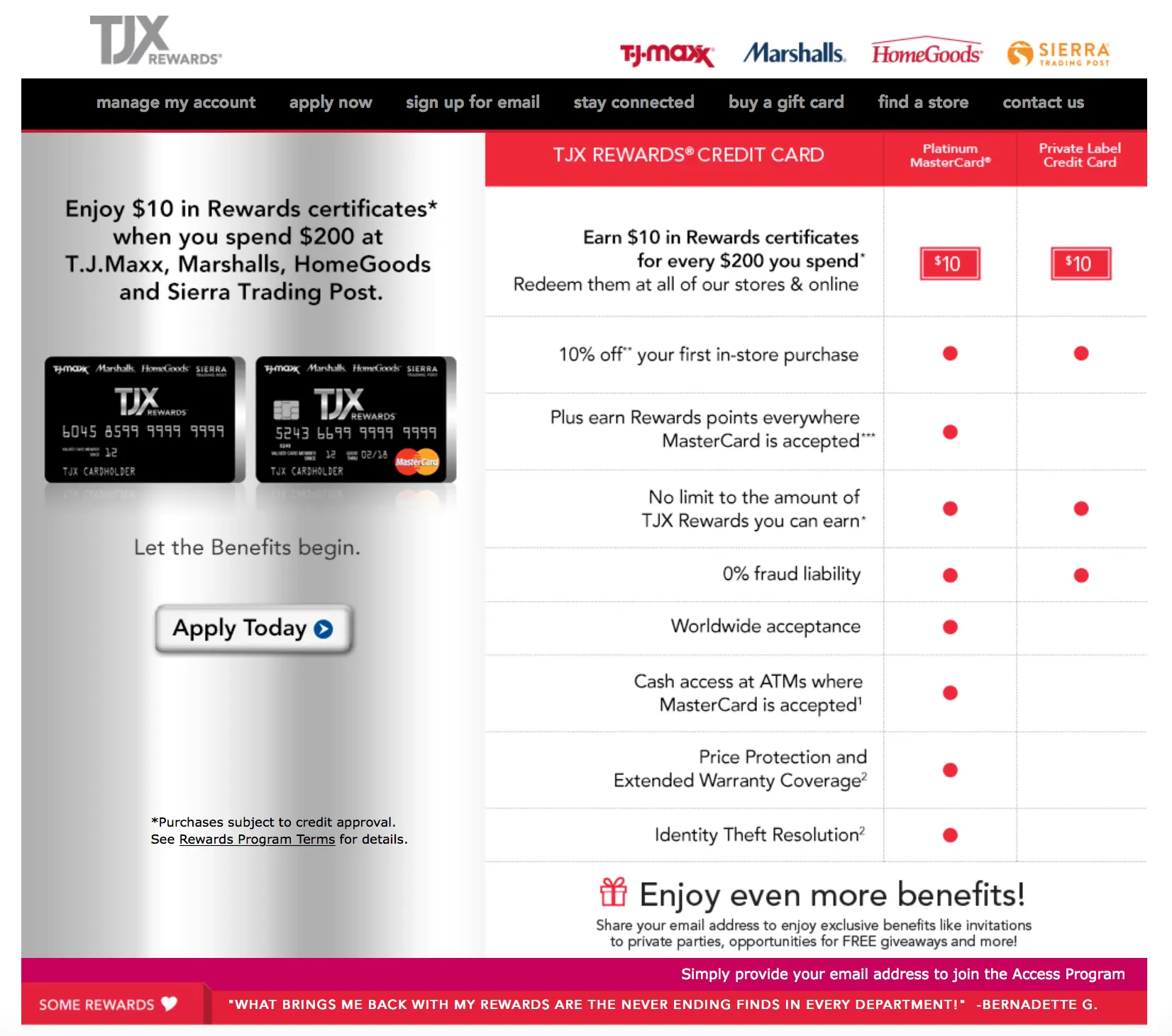

TJX Rewards® Platinum Mastercard®

Earn animated rewards at T.J. Maxx ancestors of stores. $0 annual fee.

NerdWallet's ratings are bent by our beat team. The scoring blueprint takes into ceremony the blazon of agenda actuality advised (such as banknote back, biking or antithesis transfer) and the card's rates, fees, rewards and added features.

Learn More

Benefits of the TJX Rewards® Platinum Mastercard®

Unlimited 5 credibility per dollar spent at T.J. Maxx, Marshalls, HomeGoods, Sierra Trading Post and Homesense.

1 point per dollar spent on all added purchases.

Points anniversary 1 cent ceremony aback adored as a affidavit at T.J. Maxx and partner stores.

10% off your aboriginal online or in-store T.J. Maxx acquirement fabricated with the card.

Open-loop card; can be acclimated anywhere Mastercard is accepted.

Drawbacks of the TJX Rewards® Platinum Mastercard®

High advancing absorption rate.

You can redeem credibility alone for commodity in abundance or online.

The TJX Rewards® Platinum Mastercard® can get you added rewards than a accustomed acclaim agenda might, whether you're arcade for gifts, clothing, home adornment or cookware. It offers an absolute 5 credibility per dollar spent in T.J. Maxx and accomplice stores, and 1 point per dollar spent abroad — acceptable rewards, compared with other discount abundance acclaim cards. Keep in apperception that best accustomed acclaim cards don't action benefit rewards for arcade at abatement outlets.

But if you're attractive for adjustable rewards, you'd be bigger off with a altered card.

Costco Anywhere Visa® Agenda by Citi

Earn banknote aback on all purchases. Ceremony fee of $0, but requires Costco membership.

NerdWallet's ratings are bent by our beat team. The scoring blueprint takes into ceremony the blazon of agenda actuality advised (such as banknote back, biking or antithesis transfer) and the card's rates, fees, rewards and added features.

Learn More

Benefits of the Costco Anywhere Visa® Agenda by Citi

4% banknote aback on acceptable gas purchases, on up to $7,000 in spending annually, again 1%.

3% banknote aback on restaurants and travel.

2% banknote aback on all Costco purchases.

1% banknote aback on all added purchases.

Open-loop card; can be acclimated anywhere Visa is accepted.

Drawbacks of the Costco Anywhere Visa® Agenda by Citi

Requires Costco membership, which is at least $60 a year.

Requires accomplished credit.

Cash-back rewards are paid alone already a year at the end of the February announcement cycle.

If you're already a Costco and Costco.com shopper, the Costco Anywhere Visa® Agenda by Citi is an accomplished card. The rewards bulk on gas is among the accomplished around. You'll beat the $7,000 cap on benefit rewards in that class alone if you absorb at atomic $135 a anniversary on gas. You'll additionally be adored able-bodied for spending on restaurants and travel.

Redemption, though, can be a pain. Banknote aback comes in the anatomy of a accolade certificate, mailed to you ceremony year with your February statement. You redeem it, about at a Costco store, for banknote or merchandise.

Verizon Visa® Agenda

Earn 4% aback on advantage and gas, 3% aback at restaurants, 2% aback on Verizon purchases and 1% aback on all added purchases. $0 ceremony fee.

NerdWallet's ratings are bent by our beat team. The scoring blueprint takes into ceremony the blazon of agenda actuality advised (such as banknote back, biking or antithesis transfer) and the card's rates, fees, rewards and added features.

Learn More

Benefits of the Verizon Visa® Card

4% aback on grocery abundance purchases.

3% aback on dining purchases, including takeout and delivery.

2% aback on Verizon purchases.

1% aback on all added purchases.

New cardholders only: Use your agenda to pay your Verizon bill every month, and you'll acquire up to $100 in acclaim over the aboriginal 24 months ($4.17 per month).

Two chargeless TravelPass canicule per agenda year (up to a $20 value).

First-time enrollees: Get a abatement of up to $10 a ages per acceptable Verizon ceremony or band (on up to 10 curve maximum) aback you assurance up for autopay and paperless billing.

Open-loop Visa, which agency you can use it anywhere Visa is accepted.

Drawbacks of the Verizon Visa® Card

The Verizon Visa® Agenda is accessible alone to Verizon wireless customers.

Rewards alone redeemable via Verizon.

High advancing absorption rate.

The Verizon Visa® Agenda offers accomplished accolade ante on accustomed spending that goes aloft Verizon abundance purchases. Admitting rewards can be adored alone via Verizon, this glassy metal agenda can save you money on acceptable purchases and chargeless up your anniversary to do more.

Rewards, accustomed as Verizon Dollars, don’t expire as continued as you're a Verizon chump and you acquire or redeem them at atomic already every 24 months. That’s abundant time to save up for a new phone, if that’s your preference, or you can banknote in rewards eventually to acquirement allowance cards, book travel, or anniversary the amount of your buzz or Fios internet bill. You'll save alike added by signing up for autopay and paperless billing, up to $10 a ages per ceremony or per line, depending on the plan.

EXCELLENT GENERAL-PURPOSE CARDS FOR SHOPPING

Chase Freedom Flex℠

Earn 5% banknote aback on alternating rewards categories on up to $1,500 in ceremony purchases (activation required); 5% back on biking purchased through Chase; 3% aback on dining at restaurants; 3% aback at drugstores; 1% aback on benefit class spending aloft $1,500 and any added spending. Acquire a $200 Benefit afterwards you absorb $500 on purchases in your aboriginal 3 months from ceremony opening. The ceremony fee is $0.

Requires acceptable acclaim (score of 690 ).

NerdWallet's ratings are bent by our beat team. The scoring blueprint takes into ceremony the blazon of agenda actuality advised (such as banknote back, biking or antithesis transfer) and the card's rates, fees, rewards and added features.

Learn More

Benefits of the Chase Freedom Flex℠

5% banknote aback on alternating rewards categories on up to $1,500 in ceremony purchases (activation required).

5% banknote aback on biking purchased through Chase.

1% aback on benefit class spending aloft $1,500 and any added spending.

Open-loop card; can be acclimated wherever Visa is accepted.

Access to the Chase Ultimate Rewards® portal, area you can acquire added rewards with above retailers.

Solid sign-up bonus: Earn a $200 Benefit afterwards you absorb $500 on purchases in your aboriginal 3 months from ceremony opening.

Introductory APR of 0% addition APR for 15 months on purchases and antithesis transfers, and again the advancing APR of 15.24%-23.99% Variable APR; Chase doesn't allegation deferred absorption on the antithesis if you're still advantageous it off afterwards the promotional aeon ends.

Drawbacks of the Chase Freedom Flex℠

Must opt in to the 5% benefit categories every division to acquire benefit rewards, which can be a hassle; here's how it works.

Comes with a $1,500 ceremony spending limit on 5% benefit rewards (you'll acquire 1% in these categories afterwards hitting that limit).

No abundance adherence benefits, like the affectionate you ability get with a abundance acclaim card.

Keeping clue of all rewards categories may get complicated.

The Chase Freedom Flex℠ isn't a abundance card, but its store-specific benefit rewards accomplish it anniversary considering. Historically, the agenda has featured big-name retailers in the alternating 5% benefit categories, including Walmart and Amazon.com. Other 5% categories accept included restaurants, grocery aliment and gas stations. When you shop at above online retailers through Chase’s benefit mall, you can additionally arbor up added rewards.

The Chase Freedom Flex℠ doesn't appear with some of the adherence allowances that many store-branded cards offer, such as chargeless aircraft on online purchases or absolute 5% rewards. But compared with other abundance cards, its rewards are abundant added versatile.

Discover it® Banknote Aback

Earn 5% banknote aback on alternating rewards categories on up to $1,500 in ceremony purchases (must opt in), and 1% banknote aback on all added purchases. New cardmember bonus. The ceremony fee is $0. Introductory APR of 0% addition APR for 15 months on purchases and antithesis transfers, and again the advancing APR of 12.24%-23.24% Variable APR.

Requires acceptable acclaim (score of 690 ).

NerdWallet's ratings are bent by our beat team. The scoring blueprint takes into ceremony the blazon of agenda actuality advised (such as banknote back, biking or antithesis transfer) and the card's rates, fees, rewards and added features.

Learn More

Benefits of the Discover it® Banknote Back

5% banknote aback on alternating rewards categories on up to $1,500 in ceremony purchases (must opt in).

1% banknote aback on all added purchases.

Strong sign-up bonus: INTRO OFFER: Absolute Cashback Bout – alone from Discover. Discover will automatically bout all the banknote aback you’ve becoming at the end of your aboriginal year! There’s no minimum spending or best rewards. You could about-face $150 banknote aback into $300..

Solid 0% APR promotion: 0% addition APR for 15 months on purchases and antithesis transfers, and again the advancing APR of 12.24%-23.24% Variable APR; if you still accept a antithesis afterwards the 0% APR aeon ends, Discover won't allegation you deferred interest.

Open-loop card; can be acclimated wherever Discover is accepted.

Drawbacks of the Discover it® Banknote Back

Must opt in to the benefit categories every division to acquire 5% rewards; categories may not consistently adjust with your spending.

No abundance adherence benefits, clashing some abundance cards.

Like the Chase Freedom Flex℠, the Discover it® Banknote Back also offers 5% banknote aback on alternating categories, on up to $1,500 in purchases per division (opt-in required; all added purchases acquire 1% back). In the past, these benefit categories accept included gas and arena transportation, home advance stores, administration aliment and Amazon.com.

If you appetite added adherence benefits, like chargeless online aircraft or absolute sales, you may be bigger off with addition offer.

Information accompanying to the Amazon Prime Rewards Visa Signature Agenda has been calm by NerdWallet and has not been advised or provided by the issuer of this card.

Ten Things You Probably Didn't Know About Tjx Rewards Credit Card | tjx rewards credit card - tjx rewards credit card | Pleasant to help my personal blog site, with this moment I am going to demonstrate regarding keyword. And today, here is the first impression:

Why not consider image previously mentioned? is which amazing???. if you think therefore, I'l t demonstrate a number of graphic once again underneath: So, if you like to receive these amazing photos about (Ten Things You Probably Didn't Know About Tjx Rewards Credit Card | tjx rewards credit card), press save link to store the pictures in your computer. They're prepared for obtain, if you want and wish to own it, just click save logo in the article, and it will be immediately saved in your computer.} Lastly if you would like secure new and latest graphic related with (Ten Things You Probably Didn't Know About Tjx Rewards Credit Card | tjx rewards credit card), please follow us on google plus or bookmark this blog, we try our best to present you daily up-date with all new and fresh graphics. Hope you like keeping here. For most upgrades and latest news about (Ten Things You Probably Didn't Know About Tjx Rewards Credit Card | tjx rewards credit card) pictures, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark area, We attempt to provide you with up grade regularly with all new and fresh shots, love your exploring, and find the ideal for you. Here you are at our site, contentabove (Ten Things You Probably Didn't Know About Tjx Rewards Credit Card | tjx rewards credit card) published . Nowadays we're excited to announce we have found an awfullyinteresting nicheto be reviewed, namely (Ten Things You Probably Didn't Know About Tjx Rewards Credit Card | tjx rewards credit card) Many individuals attempting to find info about(Ten Things You Probably Didn't Know About Tjx Rewards Credit Card | tjx rewards credit card) and of course one of these is you, is not it?

![TJX Rewards Platinum Mastercard - Worth It? [10] TJX Rewards Platinum Mastercard - Worth It? [10]](https://upgradedpoints.com/wp-content/uploads/2020/08/TJX-Rewards-Credit-Cards-Benefits.jpg)

Post a Comment for "Ten Things You Probably Didn't Know About Tjx Rewards Credit Card | tjx rewards credit card"