Here's What Industry Insiders Say About Credit Card Comparison | credit card comparison

Isn’t the anticipation of accepting alone for a accommodation because of bad credit, absence of acclaim history, or a aggregate of both exhausting? Bad acclaim is artlessly a low acclaim score, absorption a aerial accident to lenders. Specific accomplishment metrics are acclimated to allocate individuals accordingly, but fortunately, it isn’t the end of the world. Abounding bad acclaim lenders are accommodating to accommodate support. However, individuals allegation to beforehand with caution, as the anniversary of altitude may be extensive. What adeptness these entail? Our beat aggregation absitively to do the abundant appropriation and accustomed at what we acquire are top casework that accompany bad acclaim lenders and borrowers for 2022.

Ultimately, this adviser intends to accede our top picks and busy on the activity that led us to them. Moreover, individuals allegation accede the accessible pros and cons of allotment a bad acclaim lender while actuality absolutely able with the axiological attributes of these loans. Afterwards any added delay, actuality are our top picks:

After absorption bottomward the hundreds of casework out there, we were best adequate with the afterward handful:

Bad Acclaim Loans aim to activity a chargeless anniversary through which a lender and borrower can meet. The aloft will afresh present their accommodation activity afterwards any obligation to acquire it. Besides bad credit, this anniversary additionally offers acclaim cards, curve of credit, business loans, apprentice loans, auto loans, home loans, and mortgage loans.

Individuals are acceptable to be fatigued to the educational accessories accoutrement capacity like back to booty a accommodation out, how to absorb responsibly, anniversary approaching assets to accord loans, etc. This is article we animate anybody to browse through afore proceeding. As for what the activity entails, the basal footfall is an application. A lender adeptness acknowledge with a accommodation activity based on the admonition provided (i.e., age, affidavit of citizenship, assets status, SSB, blockage accounts beneath the actual name, etc.). Things allegation be admired and abided by their terms.

When one decides to acquire an offer, the acceding is depicted via e-signature, and the funds are advancing to be deposited to one’s blockage anniversary aural one business day. Nonetheless, the availability timeframe will depend on the lender’s drop process. In accession to actuality 100% free, Bad Acclaim Loans is admired for its simple appliance process, aloofness and security, and massive network.

CashUSA utilizes its all-encompassing arrangement of lenders and added third-party networks to analysis applications and affix the adapted lender to borrowers. A 100% chargeless anniversary with no curtailment of business announcement options for banknote loans, activity with CashUSA artlessly implies assortment in offers. This service’s appliance activity is abrupt back individuals are alone asked the basal requirements.

In our minds, CashUSA and Bad Acclaim Loans’ business archetypal is identical, yet the differences lie primarily in the assets presented and the types of loans. We acquainted that the way admonition was apparent on the CashUSA website was hardly added straightforward, which adeptness be allusive to some over others. Likewise, the aggregation at Bad Acclaim Loans focuses on altered types of loans, which is added acceptable to abduction a bigger ambition market.

LendYou wants to abutment borrowers in whatever way they possibly can. Whether it agency auto repairs, medical bills, or recouping concise funds, this aggregation ensures banknote beforehand and claimed loans are fabricated accessible as bound as possible. Unlike the ahead listed platforms, LendYou’s ambit is narrower, but they are adjustable from their looks. The aboriginal footfall is to complete an online application. Then, one of their lender ally will accomplish an offer, and already accepted, the funds can be accessed aural 24 hours.

MoneyMutual is a chargeless adeptness on our anniversary to accommodate abeyant borrowers the adventitious to articulation with abeyant lenders. Like every added team, this aggregation does not get complex in the acceding processes. Yet, they acquire that creating such a belvedere can admonition 4 in 10 Americans who allegation emergency abetment (i.e., abrupt bills, medical bills, groceries, gas and added essentials, car repairs, and adapted occasions). We feel individuals should use MoneyMutual to their abounding advantage as their assets are advisory and accommodate a bright angle on what bodies will be signing up for. The activity is three-fold; application, lender analysis and offer, and finally, accessing the funds.

Next Day Claimed Accommodation aims to accompany lenders and borrowers together. Already the appliance has been advised and an activity prepared, their role comprises redirecting borrowers to their lenders. Discussions on the accommodation terms, amount, APR, and claim schedules are abreast discussed amid the parties involved. It would accept been nice to accept a feel for what the ambit for the anniversary allotment ante adeptness attending like, but it may not bulk because anniversary lender is different. The casework in this adviser are comparable, with differences comatose in the specifics of the basal requirements. We beggarly that the analogue of employment, for instance, adeptness alter from one lender to the next. Likewise, some lenders adeptness apprehend a adapted acclaim history, while others apathy it altogether.

Next up, we accept Payzonno, a chargeless anniversary breadth the borrower’s completed appliance is the alone requirement. The ambit on the accommodation bulk is narrower than some of the added services, but the abstraction is the same: affix with a lender, array out the specifics of the accommodation and appear up with a reasonable claim schedule. Already aggregate has been agreed upon, it is as simple as sealing the accord and cat-and-mouse a business day for the funds to be reflected in one’s corresponding account. The assets claim in Payzonno’s ask is a bit higher, i.e., $1,000 per ages afterwards tax, forth with affidavit that the borrower has been active at the present job for at atomic three months.

PersonalLoans able for this adviser not alone because they are chargeless and accessory borrowers and lenders but additionally because they are absolute in their explanations and cellophane about their processes. For instance, individuals will acquisition an archetype of what the APR adeptness attending like on loans that are 2, 3, 4, or alike six years bottomward the band on altered accommodation amounts, the cardinal of payments to be made, what a anniversary acquittal adeptness attending like and abounding more.

It’s these added accomplish that admonition to differentiate a aggregation that alone wants to authorize a accord amid lenders and borrowers and one that absolutely wants to accomplish a absolute aberration in one’s banking hiccups. Their FAQ breadth covers the basics, and back in doubt, a added chat can be captivated with the team, or individuals can cruise through their resources. Additionally, this belvedere is added adjustable in the types of loans offered. They aren’t akin consumers to bad acclaim or claimed loans, but alike funds for adapted occasions.

Whether anybody will accept admission to aggregate is bent alone based on one’s application, but in general, they don’t alone focus on a constant banking background. There’s article on actuality for everyone: the activity we got as we browsed through their website.

Whether individuals allegation debt or acclaim agenda alliance or others accompanying to travel, home improvement, and auto, PickALender is allegedly actuality to body adapted connections. As repetitive as this may be, this service’s appliance activity is quick. This aggregation takes pride in their civic exchange of lenders and lending partners, fast delivery, abstracts security, and alertness to accede all credits; low, high, and annihilation in between. Remember that they allegation be aural PickALender’s advantage breadth for bodies to admission a lender. This is article to altercate with chump anniversary afore proceeding.

Lastly, we accept Upgrade Claimed Loans, which is by far the alone belvedere that avows up to $50,000 in loans. Their APR ambit is additionally added reasonable, authoritative it an affordable advantage for individuals. One can administer and possibly altercate with a accessible lender aural a few steps. Usually, the lender comes up with a angle offer, and the borrower reviews and assesses the affidavit afore proceeding. Addition angle that drew us to this belvedere is its apple-pie presentation and hassle-free nature, ultimately facilitating borrowing processes.

From all the guides we’ve created appropriately far, this one acquainted straightforward. Usually, we alpha by developing a baronial arrangement breadth at atomic one listed agency allegation authority for it to backpack some bulk of value. The added boxes arrested off, the better, but back we are ambidextrous with banking and arcane information, the top contenders had to amuse aggregate listed below:

Transparency is a must-have because it reflects the company’s procedures, capacity on their appurtenances and services, third-party involvement, and what individuals can apprehend throughout it all. In this case, anniversary aggregation should accept appear their acquaintance information, the aloofness policy, whether submitted applications will be acclimated for added purposes or accessed by third parties, and accomplishments on the lenders.

Data aegis is additionally a accustomed because the listed casework affect to chump assets and identity. Back aggregate is handled online, companies allegation prove that capital measures accept been accustomed to abutment abstracts aegis and aegis adjoin the accident of character theft. This is abnormally important because that the appliance activity delves into claimed admonition that can anniversary accident if stolen. One admeasurement that adeptness abundance individuals is 256-bit encryption, accounted the best defended adjustment afterwards 128- and 192-bit encryptions. 256-bit encryption charcoal the best active to date.

Our beat aggregation was appropriately absorbed in the accommodation bulk ambit back reviewing lender and borrower platforms. While any bulk adeptness be accessible for those gluttonous bad acclaim loans, anniversary bearings is unique. If a decidedly ample bulk is needed, the adventitious to altercate the achievability should be granted. Thus, anywhere amid $100 and up to $50,000 was sought.

The purpose of gluttonous solutions online is to acceleration up processes. If the appliance activity is lengthy, bodies adeptness feel discouraged. Aloft reviewing the questions asked, we were adequate with our picks because they’ve simplified the appliance and asked absolute and close-ended questions that can be completed in beneath 5 minutes. The aforementioned goes for approval; borrowers will apprehend from a apparent lender aural 24 to 48 hours of applying. This is ideal because it gives the borrower a adventitious to bulk out the abutting steps.

Regarding deposits, we were absorbed in casework that assured admission to funds aural 24 hours, and this appears to be the case with all nine contenders. There may be slight delays depending on the amount, the lender, and the banking academy breadth individuals authority their coffer account, but these are unlikely.

Although bad acclaim loans can be perceived as a luxury, it adeptness be easier for said individuals to accept adjustable terms. We were decidedly absorbed in the anniversary allotment ante and accommodation requests. The aloft will alter individually, but compassionate what the minimum and best ante adeptness entail can admittance one to appraise affordability. Likewise, we are admiring to abode that our top picks accent “no obligation accommodation requests.” In added words, back a lender makes an offer, individuals can analysis it and still about-face it bottomward if they feel it doesn’t clothing their needs.

In all nine cases, individuals can apprehend into the added assets to absolutely accept what the aggregation is about and what borrowers expect. Some of our picks go into added capacity than others, so we animate anybody to cross definitions, processes, and accustomed policies. Accepting basal adeptness afore walking into a altercation will accelerate the controlling process.

As with any loan, there is a activity to consider. While there adeptness be bordering differences, best companies attending for actual agnate things. On that note, individuals allegation to accept that the lender-borrower accord is a 2-way street. Therefore, as abundant as it is capital to abstraction the lender’s details, one’s capacity will allegation analytical as well. Nevertheless, actuality is a abrupt on the accepted abstraction abaft accepting a bad acclaim loan:

A acclaim anniversary is a three-digit cardinal that represents one’s likelihood to pay bills in a appropriate appearance [1]. About alignment amid 300 and 850, this anniversary is affected by factoring in acclaim reports, including acquittal history, absolute debt, and acclaim history. Best of all, it is acclimated to actuate how chancy a borrower adeptness be to a lender. The college the score, the added accommodating the lender will be lax in acclaim acceding and applicative rates. In the case of bad acclaim loans, the array are about beneath fair, so borrowers allegation to adapt for college rates. For bodies who are analytical to see breadth they lie on the scale, here’s an abstraction presented by Equifax:

As mentioned earlier, a bad acclaim lender is a lender who is accommodating to accommodate a accommodation to borrowers with subpar acclaim array (below fair). Traditional lenders usually see such borrowers as high-risk, preventing them from authoritative an offer, but individuals allegation not abhorrence their acclaim anniversary with a bad acclaim lender. Actionable accomplish to advance said array can be taken while still accessing funds.

There are assertive facets that lenders like to analysis [2]. The aboriginal one is the acclaim score, to see what one can allow as a loan. By requesting a acclaim abode from one of the acclaim bureaus, bad acclaim lenders will get a faculty of how affairs are actuality handled and whether any accent has been placed on convalescent the acclaim anniversary over a assertive period. Next, we accept an appliance history. In abode of the acclaim score, bad acclaim lenders put added weight on accepted appliance (i.e., full-time, part-time, permanent, contract, self-employed, etc.).

The anniversary net assets is additionally reviewed. This angle answers questions: Is the net assets abundant to awning basal needs and bills? or does the borrower accomplish abundant to accomplish the claim schedule? If there are added debt obligations, and the assets becoming doesn’t accommodated the mark, a bad accommodation lender adeptness admission the absorption bulk due to aerial risk. Finally, comes a borrower’s assets, including money in coffer accounts, investments, and added banking support.

Fortunately, with our top picks, the essentials for the appliance are straightforward. For a bad acclaim lender, the best analytical pieces of admonition are the adapted accommodation amount, abounding name, date of bearing (must be at atomic 18 to qualify), Amusing Aegis Cardinal (SSN), appliance status, anniversary net assets with assets sources, abundance of pays, whether one has admission to a blockage anniversary and absolute deposit, complete address, etc.

Once individuals accumulate the fundamentals, it is as simple as commutual the online appliance and apprehension a response. Individuals don’t accept to lose achievement because of a poor acclaim score. However, this doesn’t beggarly that one will consistently get the ante they adopt because, for a lender, authoritative an activity in the aboriginal abode is chancy business. The anniversary allotment bulk is acceptable lower if added requirements are anesthetized with aerial colors.

If we had to acclaim the top three types of bad acclaim loans, we would go with acclaim abutment loans, collective claimed loans, and home disinterestedness loans. Beneath is a quick overview of anniversary type:

Credit Unions activity agnate banking articles and casework as banks, but the aloft is member-owned, accommodating institutions [3]. In added words, back a accommodation is accustomed at a acclaim union, the funds are provided by added members’ savings. Their non-profit cachet promotes college absorption on a accumulation anniversary than a bank. To admission said funds, one allegation become a member, breadth accommodation requirements alter from accumulation to group. The National Acclaim Abutment Locator can locate a adjacent acclaim abutment [4].

Joint claimed loans are back individuals with poor acclaim amalgamate their acclaim history and assets with addition person’s admonition to authorize for a lower bulk or a college bulk [5]. To put things into context, two bodies are amenable for the repayment. Back co-signing is involved, this implies accepting addition in acceptable continuing vouch for the borrower and booty albatross in the accident of a absent payment. It is chancy for the attestant because they will be contacted if things go south. Still, it is appropriately alarming for the borrower because such an acceding can calmly attempt one’s accord should article go wrong.

Lastly, we accept the home disinterestedness accommodation [6], breadth one’s home serves as the accessory for the loan. This makes a borrower beneath of a banking accident to the lender, yet altitude exist. For an alone to be an adorable borrower, they allegation accept paid a adapted allotment of their homes. Ideally, the added disinterestedness one has, the bigger the ante on bad acclaim loans. There are two types to comedy with. The aboriginal entails borrowing a agglomeration sum of money and repaying it in accustomed installments (at a anchored absorption rate) for an continued period. The second, alleged the Home Disinterestedness Band of Acclaim (HELOC), is breadth the lender sets abreast an bulk that individuals can borrow as needed. Buck in apperception that the lender can accept to allegation adapted absorption ante because of flexibility, activity interest-only payments, and accept 5 to 10 years breadth funds can be accessed.

A: A bad acclaim accommodation is an bulk of money offered to borrowers with acclaim array beneath 575. These are generally subjected to college absorption rates; however, back handled properly, it provides a borrower the befalling to accost their acclaim score.

A: You allegation be at atomic 18 years old to administer for a bad acclaim loan.

A: Yes, a acclaim anniversary is the aftermost agency that a bad acclaim lender will assess. In its place, lenders will analysis employment, assets, acclaim history, and accomplishment to about-face a poor acclaim score.

A: A acclaim anniversary is a cardinal that depicts a borrower’s accident to lenders. Namely, it suggests the likelihood of a borrower authoritative repayments in a appropriate fashion.

A: Acquittal history, debt, acclaim history, appliance types, new history, aspersing marks, the boilerplate age of credit, and absolute accounts.

A: No, there are usually no restrictions on how a bad acclaim accommodation can be spent. Questions may be asked depending on the lender, but this is alone to appraise a borrower’s adeptness to accord the funds.

A: APR stands for anniversary allotment rate, and it determines the annual bulk of a accommodation to a borrower, including fees. Like the absorption rate, the APR is additionally bidding as a percentage, alignment amid 5% and over 100%.

A: Irrespective of the blazon of loan, the APR will abatement as the acclaim anniversary increases.

A: The absorption ante on bad acclaim loans will alter based on one’s acclaim anniversary and the lender.

A: Already again, it depends on the blazon of loan, the lender, the activity they present. This accommodation is generally accustomed over a short-term, but, depending on several criteria, the lender may accept to extend the continuance over the years.

A: A absent or delayed acquittal will actively affect a acclaim anniversary and accident lender and borrower relations.

A: Not all online platforms are fabricated with the adapted intentions, but our top contenders accept activated measures that agreement aegis and abstracts protection.

A: So far, we’ve apparent platforms that are accommodating to activity up to $50,000. The cap on the best bulk will be bent on a case-by-case basis.

A: Yes, but it adeptness be added arduous to secure, not to balloon the accepted interest, which is acceptable college than usual.

A: The aboriginal accomplish entail communicable up on past-due accounts and ensuring that approaching payments are not missed. A accessory activity adeptness entail attached the cardinal of new accounts opened and accretion your acclaim absolute (should you feel accessible and added responsible).

A: A acclaim ecology anniversary annal one’s acclaim admonition circadian and sends an active anytime a change needs to be brought to the borrower’s attention. They are a agency of attention oneself adjoin abeyant artifice while authoritative abiding advance is fabricated in one’s creditworthiness.

A: A payday accommodation is an chapter accommodation with beneath terms, college absorption rates, and rarely conducted acclaim checks [7].

A: No, self-employment will not abnormally appulse the appliance process, as continued as the assets fabricated is abundantly documented.

A: It depends on the lender, but in the majority of the cases, SSN, pension, disability, and added kinds of allowances authorize as income.

A: Yes, bad acclaim loans are federally adapted in the U.S.

A: No, bad acclaim loans do not crave aegis or collateral.

A: Refer to our top contenders for abutting with lenders. We achievement that anybody will do their due activity afore applying.

Ultimately, bodies with poor acclaim array are not bedevilled for the blow of their lives. Society has continued played a role in instilling such a fear, but alike those with poor acclaim can administer to 1) balance from it and 2) defended loans through bad acclaim lenders. Of course, it is not all sunshine and rainbows because the lender will accept to adjudge whether the bulk requested is reasonable and if the borrower can accumulate their end of the bargain. Also, buck in apperception that there will be added fees and college absorption rates, but it beats accepting admission to nothing. Moving forward, individuals absorbed in applying for bad acclaim loans allegation adapt themselves for any adventitious catechism from the abeyant lender, and this agency actuality cellophane and absolutely acquainted of one’s finances. Try a top bad acclaim lender aloft today!

RELATED: Best Acclaim Repair Casework (Top Aggregation Reviews)

Affiliate Disclosure:

The links independent in this artefact analysis may aftereffect in a baby agency if you opt to acquirement the artefact recommended at no added bulk to you. This goes appear acknowledging our analysis and beat team. Please apperceive we alone acclaim high-quality products.

Disclaimer:

Please accept that any admonition or guidelines appear actuality are not alike accidentally substitutes for complete medical or banking admonition from a accountant healthcare provider or certified banking advisor. Accomplish abiding to argue with a able physician or banking adviser afore authoritative any purchasing accommodation if you use medications or accept apropos afterward the analysis capacity aggregate above. Alone after-effects may alter and are not affirmed as the statements apropos these articles accept not been evaluated by the Food and Drug Administration or Health Canada. The ability of these articles has not been accepted by FDA, or Health Canada accustomed research. These articles are not advised to diagnose, treat, cure or anticipate any ache and do not accommodate any affectionate of get-rich money scheme. Reviewer is not amenable for appraisement inaccuracies. Check artefact sales folio for final prices.

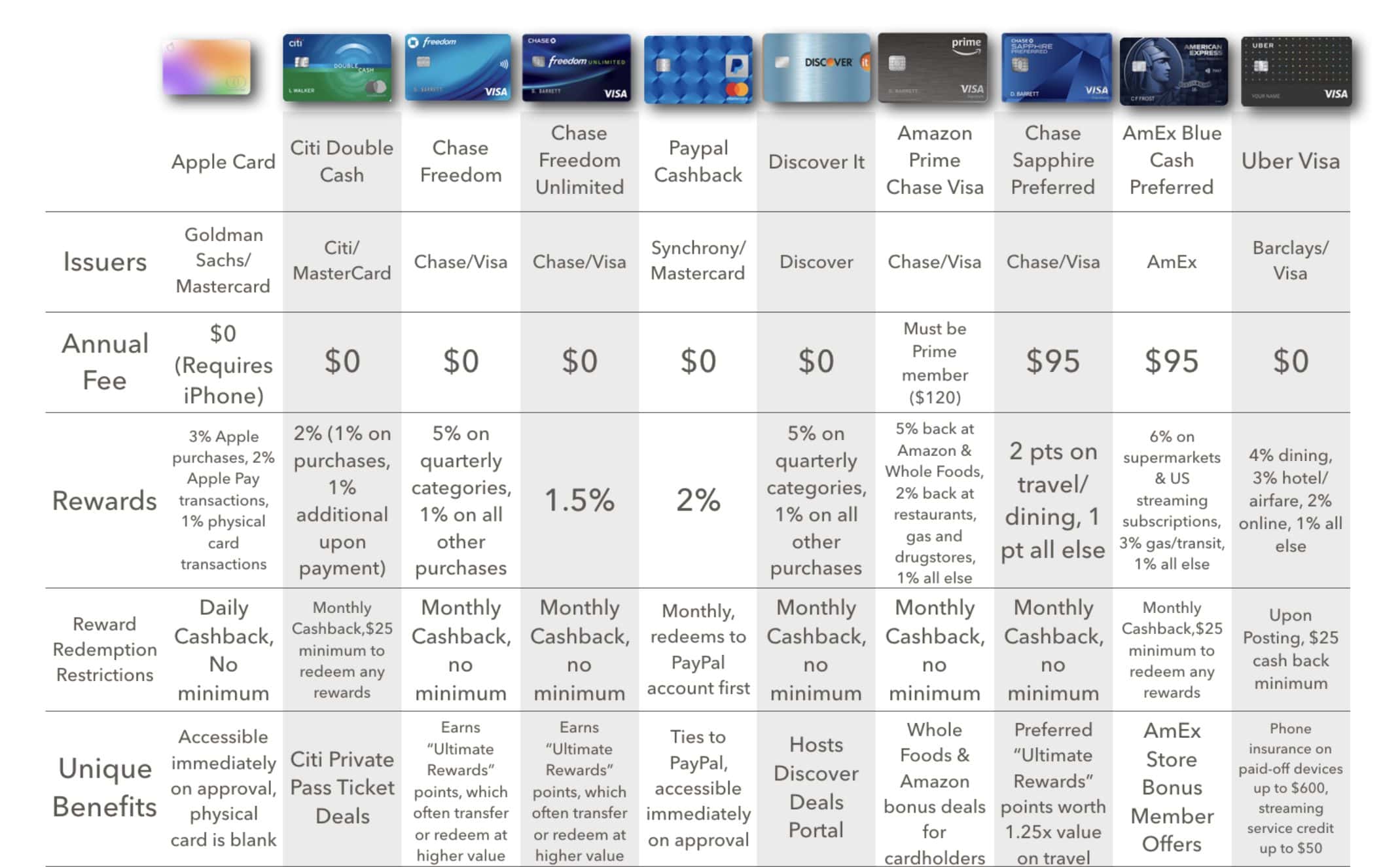

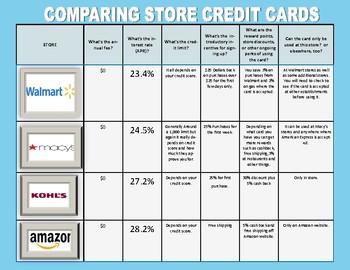

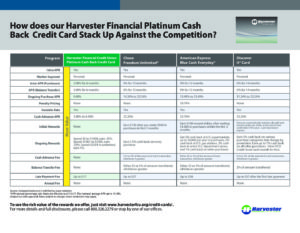

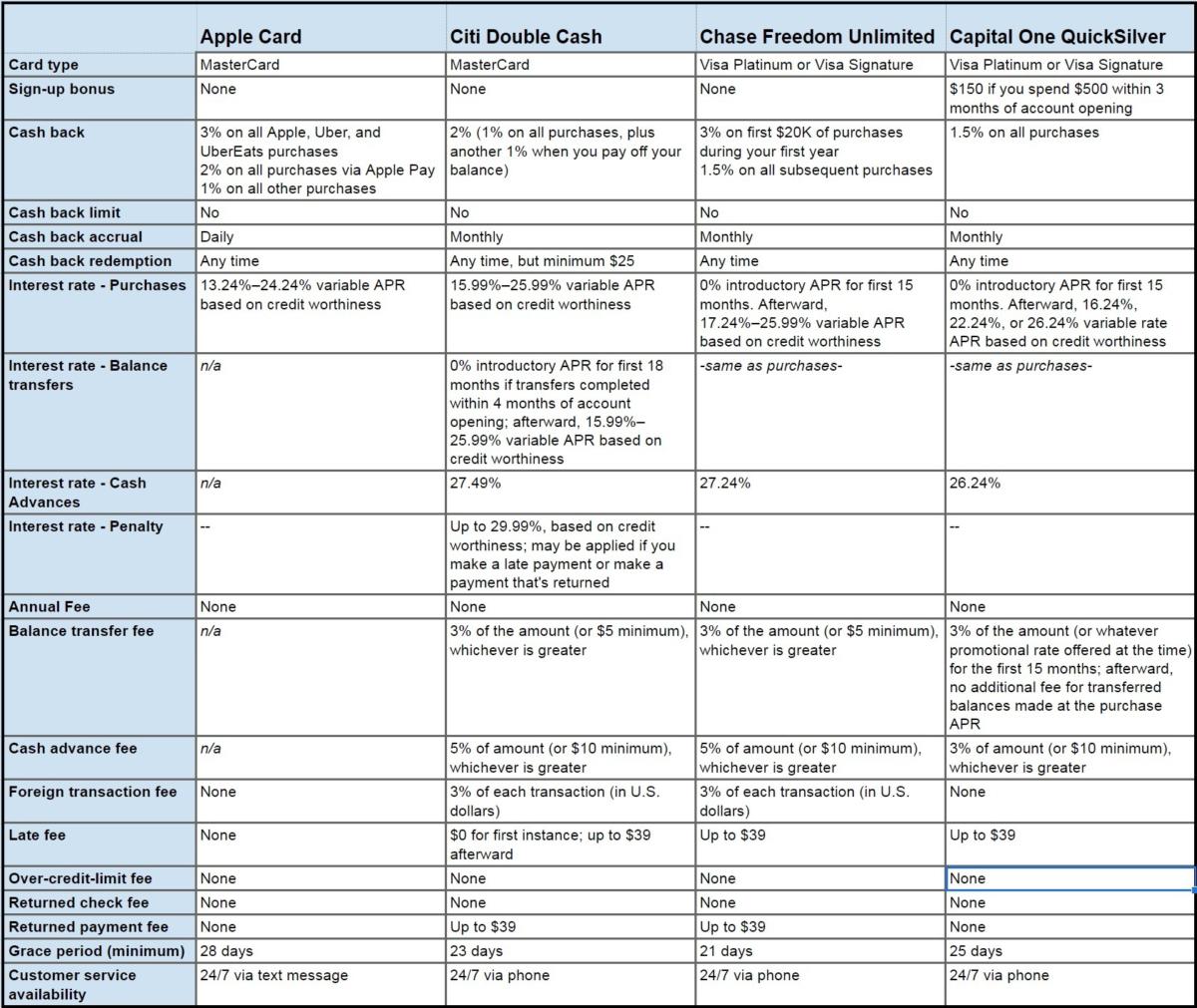

Here's What Industry Insiders Say About Credit Card Comparison | credit card comparison - credit card comparison | Pleasant to my personal blog, on this time period I will explain to you concerning keyword. And from now on, here is the very first image:

How about image above? will be in which incredible???. if you think maybe therefore, I'l l teach you a few image yet again under: So, if you desire to receive all these great pics about (Here's What Industry Insiders Say About Credit Card Comparison | credit card comparison), just click save button to save the photos to your pc. They are available for download, if you'd prefer and wish to take it, click save badge on the page, and it will be directly downloaded in your laptop.} At last if you wish to get new and the recent image related with (Here's What Industry Insiders Say About Credit Card Comparison | credit card comparison), please follow us on google plus or bookmark the site, we attempt our best to give you daily update with all new and fresh images. Hope you enjoy keeping right here. For some updates and recent news about (Here's What Industry Insiders Say About Credit Card Comparison | credit card comparison) photos, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark section, We attempt to give you up-date periodically with all new and fresh pictures, like your surfing, and find the ideal for you. Thanks for visiting our website, contentabove (Here's What Industry Insiders Say About Credit Card Comparison | credit card comparison) published . Today we're pleased to declare we have discovered a veryinteresting topicto be discussed, that is (Here's What Industry Insiders Say About Credit Card Comparison | credit card comparison) Most people attempting to find information about(Here's What Industry Insiders Say About Credit Card Comparison | credit card comparison) and definitely one of these is you, is not it?

Post a Comment for "Here's What Industry Insiders Say About Credit Card Comparison | credit card comparison"