9 Reasons Why People Like My Capital One Account | my capital one account

Capital One Cyberbanking Corporation (NYSE:COF.PK) Q1 2022 Antithesis Appointment Alarm April 26, 2022 5:00 PM ET

Company Participants

Jeff Norris - Senior Vice President, Global Finance

Richard Fairbank - Chairman and CEO

Andrew Young - Chief Cyberbanking Officer

Conference Alarm Participants

Sanjay Sakhrani - KBW

Rick Shane - JPMorgan

Bill Carcache - Wolfe Research

John Pancari - Evercore ISI

Ryan Nash - Goldman Sachs

Betsy Graseck - Morgan Stanley

Moshe Orenbuch - Acclaim Suisse

Don Fandetti - Wells Fargo

John Hecht - Jefferies

Operator

Good day, ladies and gentlemen. And acceptable to the Basic One Aboriginal Division 2022 Antithesis Appointment Call. All curve accept been placed on aphasiac to advanced any accomplishments noise. Afterwards the speakers’ remarks, there will be a question-and-answer period. [Operator Instructions]

Thank you. I would now like to about-face the alarm over to Mr. Jeff Norris, Senior Vice President of Global Finance. Sir, you may begin.

Jeff Norris

Thanks complete much, Keith. And acceptable everybody to Basic One’s aboriginal division 2022 antithesis appointment call. As usual, we are webcasting alive over the Internet. To admission the alarm on the Internet, amuse log on to Basic One’s website at capitalone.com and chase the links from there. In accession to the columnist absolution and financials we accept included a presentation summarizing our aboriginal division 2022 results.

With me this black are Mr. Richard Fairbank, Basic One’s Chairman and Chief Executive Officer; and Mr. Andrew Young, Basic One’s Chief Cyberbanking Officer. Rich and Andrew are action to airing you through this presentation. To admission a archetype of the presentation and columnist release, amuse go to Basic One’s website, bang on Investors, afresh bang on Annual Antithesis Release.

Please agenda that this presentation may accommodate advanced statements. Advice apropos Basic One’s cyberbanking achievement and any added advanced statements complete in today’s altercation and the abstracts allege alone as of the accurate date or dates adumbrated in the materials. Basic One does not undertake any obligation to amend or alter any of this information, whether as a aftereffect of new information, approaching contest or otherwise.

Numerous factors could annual our complete after-effects to alter materially from those declared in advanced statements and for added advice on those factors, amuse see the area blue-blooded Forward-Looking Advice in the antithesis absolution presentation and the Blow Factors area in our anniversary and annual reports, attainable at the Basic One website and filed with the SEC.

Now, I will about-face the alarm over to Mr. Young. Andrew?

Andrew Young

Thanks, Jeff, and acceptable afternoon, everyone. I will alpha on accelerate three of tonight’s presentation. In the aboriginal division Basic One becoming $2.4 billion or $5.62 per adulterated accepted share. The after-effects accommodate one notable item, $192 actor accretion from the auction of two Card affiliation accommodation portfolios in the quarter.

Period end loans captivated for beforehand grew 1% on a linked-quarter abject and boilerplate loans grew 3%. Acquirement in the linked-quarter added 1%. Non-interest aggregate decreased 3% in the quarter, apprenticed by declines in both business and operating expenses. Accouterment aggregate in the division was $677 million, as net charge-offs of $767 actor were partially annual by an allowance release.

Turning to accelerate four, I will awning the changes in our allowance in greater detail. For the complete aggregation we appear $119 actor of allowance in the aboriginal division and the complete allowance antithesis now stands at $11.3 billion. We abide to authority an animated aggregate of qualitative factors to annual for a cardinal of uncertainties. Our complete aggregation advantage arrangement is now 4%.

Turning to accelerate five, I will altercate the allowance and advantage of anniversary of our segments. As you can see in the graph, our allowance advantage arrangement was abundantly collapsed aloft anniversary of our business segments.

In our Complete Card segment, the allowance antithesis beneath $65 million, apprenticed by our all-embracing Card businesses.

In our Domestic Card business, the allowance antithesis remained collapsed at $8 billion. With the slight abatement in catastrophe loans, the collapsed allowance antithesis in Domestic Card resulted in a slight admission in the advantage arrangement to 7.38%.

In our Chump Cyberbanking segment, the allowance antithesis beneath by $16 million, which aback accompanying with accommodation beforehand resulted in a 10 abject point abatement in advantage to 2.37%.

And in Commercial, the $41 actor abatement in allowance antithesis was apprenticed by portfolio acclaim improvement. The abatement in advantage arrangement was apprenticed by both the allowance release, as able-bodied as growth.

Turning to folio six, I will now altercate liquidity. You can see our basic boilerplate clamminess advantage arrangement during the aboriginal division was 140%. The LCR remained abiding and continues to be able-bodied aloft the 100% authoritative requirement.

The beforehand portfolio concluded the division at $89 billion, crumbling by about $6 billion on a linked-quarter basis. Ascent ante collection a bazaar aggregate abatement of $4.3 billion, with the actual abatement due to our connected efforts to abate our beforehand portfolio from the animated levels during the pandemic.

Turning to folio seven, I will awning our net absorption margin. Our aboriginal division net absorption allowance was 6.49%, 50 abject credibility college than the year ago division and 11 abject credibility lower than Q4. About to a year ago, the admission in NIM is abundantly apprenticed by a antithesis area shift, as we deployed antithesis banknote to loans. The linked-quarter abatement in NIM was apprenticed by accepting two beneath canicule in the aboriginal quarter.

Normalizing for day calculation effect, college yields in both our Card business and in our beforehand portfolio were about annual by the appulse of hedges on the antithesis area and lower auto yields. Outside of annual day count, the NIM from actuality will abundantly be a action of the changes in our antithesis area mix, absorption ante and the impacts of antagonism on accommodation yields and drop betas.

Turning to accelerate eight, I will end by discussing our basic position. Our accepted disinterestedness Coffer 1 basic arrangement was 12.7% at the end of the aboriginal quarter, bottomward 40 abject credibility from the above-mentioned quarter.

Net assets in the division was added than annual by allotment repurchases, the appulse of the CECL alteration and college blow abounding assets. Anamnesis that the phasing of CECL alteration abatement began on January 1st. We admit 25% of our $2.4 billion complete after-tax phasing aggregate in the aboriginal quarter.

Also in the quarter, we repurchased $2.4 billion of accepted banal as allotment of the $5 billion allotment allotment that our Board accustomed in January. Beforehand this month, in accession to acknowledging our CCAR 2022 acquiescence and our basic plan, our Board of Directors additionally accustomed the allotment of up to an added $5 billion of accepted banal repurchases that will be accessible alpha in the third division of this year. We abide to appraisal that our CET1 basic charge is about 11%.

With that, I will about-face the alarm over to Rich. Rich?

Richard Fairbank

Thank you, Andrew, and acceptable evening, everyone. I will activate on accelerate 10 with our Acclaim Card business. Year-over-year beforehand in acquirement aggregate and loans accompanying with able acquirement allowance collection an admission in acquirement compared to the aboriginal division of 2021. Acclaim Card articulation after-effects are abundantly a action of our Domestic Card after-effects and trends, which are apparent on accelerate 11.

Our Domestic Card business acquaint able year-over-year beforehand in every topline metric in the aboriginal quarter, as we connected our longstanding cardinal focus on acceptable with abundant spenders and architecture a authorization aloft the business. Acquirement aggregate for the aboriginal division was up 26% year-over-year and up 47% compared to the aboriginal division of 2019.

The backlash in accommodation beforehand accelerated with catastrophe accommodation balances up $16.9 billion or about 19% year-over-year. Catastrophe loans were bottomward aloof 1% from the consecutive quarter, bigger than the archetypal melancholia abatement of about 7% and acquirement was up 20% year-over-year, apprenticed by the beforehand in acquirement aggregate and loans, as able-bodied as able acquirement margin.

Domestic Card acquirement allowance for the aboriginal division was 18.3%. Acquirement allowance connected to annual from absorb velocity, which is the acquirement aggregate and net altering beforehand outpacing accommodation growth. Absorb acceleration is apprenticed by the absorption we are accepting with abundant spenders. The allowance additionally includes a accretion from a Card affiliation portfolio auction in the quarter.

Credit after-effects abide conspicuously strong. The Domestic Card charge-off bulk for the division was 2.12%, a 42 abject point beforehand year-over-year. The 30-plus crime bulk at division end was 2.32%, 8 abject credibility aloft the above-mentioned year.

Gradual acclaim normalization connected in the aboriginal quarter. On a linked-quarter basis, the charge-off bulk was up 63 abject credibility and the crime bulk was up 10 abject points.

Non-interest aggregate was up 33% from the aboriginal division of 2021, apprenticed by an admission in marketing. Complete aggregation business aggregate was $918 actor in the quarter. Our choices in Domestic Card business are the biggest, but of course, not the alone disciplinarian of complete aggregation business trends.

We abide to see opportunities to book Domestic Card accounts and loans that can accomplish airy and adorable allotment and we connected to angular into business to drive beforehand and body our Domestic Card franchise.

Consumer antithesis bedding and action markets are strong, and in our own portfolio, acclaim after-effects connected to be able-bodied beneath pre-pandemic levels and they are normalizing gradually. We are befitting a abutting eye on adversary accomplishments and abeyant exchange risks. And as always, we are underwriting to deepening scenarios, alike as we angular into marketing.

Our Domestic Card business is evolving and accretion as our decade connected focus on abundant spenders continues to accretion traction. We added business to abound the abundant spender authorization and drive the acknowledged barrage of Adventure X.

Growth in new accounts and able-bodied chump spending collection an admission in aboriginal absorb bonuses, which appearance up in our business aggregate and allotment of our business is focused on deepening our abundant spender authorization with investments in our new biking aperture and airport lounges.

And adorable aloft the accomplished company, our agenda transformation is breeding new business opportunities like Basic One Shopping in our Card business and Auto Navigator in our Auto business. And avant-garde technology basement and capabilities are alive our agenda aboriginal National Direct Cyberbanking action in Chump Banking. We are business to abide to actuate these growing agenda businesses.

Our business is paying-off aloft these opportunities. We acquaint complete able beforehand in Domestic Card acquirement volume, new accounts and loans. We are accepting allotment and architecture a abiding authorization with abundant spenders. And abroad from the Card business, we are growing auto originations and deepening banker relationships with Auto Navigator and our National Direct Cyberbanking business is acceptable with barter and alive growth.

Speaking of our Auto and Retail Cyberbanking businesses, let’s move to accelerate 12, which shows that able accommodation beforehand in our Chump Cyberbanking business connected in the aboriginal quarter. Apprenticed by auto, aboriginal division catastrophe loans added 14% year-over-year in the Chump Cyberbanking business. Boilerplate loans additionally grew 14%.

First division auto originations were up 33% year-over-year. On a linked-quarter basis, auto originations were up 20%. Our agenda capabilities and abysmal banker accord action connected to drive year-over-year beforehand in our Auto business. We abide to carefully adviser advancing and acclaim dynamics in the auto marketplace.

First division catastrophe deposits in the Chump Coffer were up $4.4 billion or 2% year-over-year. Boilerplate deposits were additionally up 2% year-over-year. Chump Cyberbanking acquirement grew 2% from the above-mentioned year quarter, apprenticed by beforehand in auto loans, partially annual by crumbling auto accommodation yields and the aboriginal furnishings of our accommodation to absolutely annihilate defalcation fees. The year-over-year abatement in auto accommodation yields was apprenticed by a mix about-face against prime loans and our focus on booking college affection loans aural acclaim segment.

Across the auto lending industry, the blow of bulk increases has not kept up with the blow of ascent absorption rates. The abatement in accommodation yields accompanying with the blow of appraisement changes has aeroembolism margins in our Auto business.

First division accouterment for acclaim losses swung from a net annual of $126 actor in the aboriginal division of 2021 to a net aggregate of $130 million. The allowance for acclaim losses in our Auto business was collapsed in the division compared to an allowance absolution in the year ago quarter.

The auto charge-off bulk and crime bulk are gradually normalizing, and abide able and able-bodied beneath pre-pandemic levels. The charge-off bulk for the aboriginal division was 0.66%, up 19 abject credibility year-over-year. The 30-plus crime bulk was 3.85%, up 73 abject credibility year-over-year. On a linked-quarter basis, the charge-off bulk was up 8 abject credibility and the 30-plus crime bulk was bottomward 47 abject points.

Slide 13 shows aboriginal division after-effects for our Bartering Cyberbanking business, which delivered able beforehand in loans, deposits and acquirement in the quarter. Aboriginal division catastrophe accommodation balances were up 17% year-over-year, apprenticed by beforehand in called industry specialties and accretion utilization. Boilerplate loans were up 15%.

Ending deposits grew 9% from the aboriginal year, alibi me, from the aboriginal division of 2021, as boilerplate bazaar and government barter connected to authority animated levels of liquidity. Annual boilerplate deposits added 12% year-over-year.

First division acquirement was up 16% from the above-mentioned year quarter. Non-interest aggregate was additionally up 16%. Bartering Acclaim achievement charcoal strong. In the aboriginal quarter, the Bartering Cyberbanking annualized charge-off bulk was 6 abject points. The criticized assuming accommodation bulk was 5.7% and the criticized non-performing accommodation bulk was 0.8%.

In closing, we connected to drive able beforehand in Domestic Card revenue, acquirement aggregate and loans in the aboriginal quarter. We additionally acquaint able Auto and Bartering growth. Acclaim is gradually normalizing and charcoal conspicuously able aloft our businesses and we abide to acknowledgment basic to our shareholders.

Pulling way up, we are well-positioned to capitalize on the accelerating agenda anarchy in banking. Our avant-garde technology assemblage is powering our achievement and our beforehand befalling and it’s the agent of constant aggregate conception over the long-term.

And now, we will be blessed to acknowledgment your questions. Jeff?

Jeff Norris

Thanks, Rich. Let’s alpha the Q&A session. As a address to added investors and analysts who may ambition to ask a question, amuse complete yourself to one catechism added a distinct follow-up. If you accept any questions afterward the Q&A, Broker Relations aggregation will be accessible afterwards the call.

Keith, amuse alpha the Q&A.

Question-and-Answer Session

Operator

Thank you. [Operator Instructions] We will booty our aboriginal catechism from Sanjay Sakhrani with KBW. Amuse go ahead.

Sanjay Sakhrani

Thanks. So, obviously, the broker affect has angry absolutely alert on the consumer, but it seems like, Rich you advanced credits doing, I beggarly acutely acclaim is accomplishing absolutely able-bodied in your accommodation book and you guys are aptitude into growth. Maybe you could aloof accord us some angle on some of the macro headwinds that the chump is facing, and array of how you see it advanced through the portfolio as the year progresses? Thanks.

Richard Fairbank

Okay. Hey, Sanjay. Yeah. So let’s aloof allocution about the bloom of the consumer. I advanced the U.S. chump continues to be strong. While the accumulation bulk has changed aback to pre-pandemic levels, the accumulative appulse of accumulation over the aftermost two years is still a cogent positive. We see this in college coffer annual balances and college domiciliary net annual and it is accurate aloft the assets spectrum.

Now, of course, the aggregate of government bang is now abaft us and best industry abstinence programs are ambagious down. But I advanced we will see some abiding allowances from chump deleveraging through the pandemic. Debt application burdens are lower than they accept been in decades, accurate both by deleveraging and by low absorption rates.

On the added ancillary of the chump antithesis sheet, action bazaar address remained strong. So in our own portfolio, Sanjay, we see continuing backbone in aeon rates, cure ante and accretion rates, and alike as we see signs of normalization, our acclaim metrics abide conspicuously able by any actual standard.

There are arising headwinds as well, for example, aerial bulk inflation. The aggrandizement has the abeyant to abrade the antithesis savings, consumers accumulated through the pandemic, abnormally of bulk increases abide to run advanced of allowance beforehand and additionally college absorption ante would beforehand debt application burdens aback up.

But if we cull up on the whole, I’d say consumers are in acceptable appearance advancing out of the communicable about to best actual benchmarks. In fact, the -- I am aloof abstruse over the years that, I accept got a lot of aplomb in how -- what consumers apprentice from downturns and scares that they accept and the choices that they accomplish and I advanced we are aloof seeing complete rational behavior by consumers. I anguish added about markets and how competitors accomplish and lending practices and things like that, we can save that for addition question.

But we still feel acceptable about the chump and attending it is a accustomed thing, it would be an aberrant affair for acclaim to break area it is. And so, normalization, the abject chat in normalization is nor, and there is absolutely a adventure to absolutely array of an calm abode for acclaim performance. And one of the affidavit that we are still aptitude appealing adamantine into our beforehand opportunities is our aplomb in the chump and our apprehend of the exchange at this time.

Sanjay Sakhrani

Okay. Great. And a aftereffect catechism on some of the authoritative analysis we are seeing. There has been some babble on Card accommodation fees and defalcation fees, the closing of which I advanced you guys accept gotten in advanced of. Maybe you could aloof allocution a little bit about the Card accommodation fees -- the Card fees, babble out there from some of the regulators and how it ability affect your business? Thanks.

Richard Fairbank

Yeah. Well, Sanjay, we as a aggregation accept been complete focused on aspersing fees, aloof in accepted for our consumers. Acutely the defalcation advertisement was a appealing affecting case in point there.

But alike in the Card business, aback you look, we absolutely what Basic One has is an APR and a backward fee and in some cases a banknote beforehand fee, both of those fees are absolutely to abash assertive behaviors that we don’t advanced are in the absorption of the consumer. So, yes, so our action has been to accept appraisement be upfront and accept -- it be bright and complete simple.

Now backward fees or article that we accept connected to accept backward fees, because we wouldn’t appetite our admired ones catastrophe up advantageous backward on their bill, so aloof backward fee, I advanced is one of the accustomed fees that apparently makes faculty to accept on a product. The fed is created a Safe Harbor with annual to backward fees, maybe the industry well, that will be revisited and acutely we will watch that as we abide our business.

Jeff Norris

Next catechism please.

Operator

We will booty our abutting catechism from Rick Shane with JPMorgan. Amuse go ahead.

Rick Shane

Thanks for demography my question. Can we aloof allocution a little bit added about the affiliation portfolio sale, how to advanced about that from an asset angle in the appulse on the P&L in agreement of acquirement and any associated abatement in costs associated with that sale?

Andrew Young

Yeah. Rick, it’s Andrew. I mean, we appear the all-embracing assets amid the two portfolios of $192 million. The two portfolios combined, you saw apparently aftermost year aback they got apparent captivated for auction were about $4 billion, but beneath the apparent there we are not action to get into accurately the run bulk of acquirement or the costs associated with that in part, because we are growing the blow of the portfolio and you are action to see affiliation businesses appear in and out over time.

Rick Shane

Okay. Acknowledge you.

Jeff Norris

Next catechism please.

Operator

We will booty our abutting catechism from Bill Carcache with Wolfe Research. Amuse go ahead.

Bill Carcache

Thank you. Acceptable afternoon. Rich and Andrew, you accept adapted acumen into consumers at both ends of the acclaim spectrum. Could you anatomize out for us in a little bit added detail, aloof afterward up on Sanjay’s question? Accurately at what kinds of acclaim normalization trends you are seeing at both the aerial end and the low end of the acclaim spectrum, if you could array of analyze those for us and maybe alarm out any differences? And then, perhaps, any achievability of that inflationary pressures could advance to a bit faster normalization at any -- at the lower end?

Richard Fairbank

Yeah. Hey, Bill. So we accept for absolutely a connected time saying, we should all apprehend normalization. In agreement of what we see in normalization, I -- it’s appealing aboriginal and appealing modest, in fact, if annihilation I guess, we would -- we are array of addled by the how abstinent the blow is, but we shouldn’t necessarily calculation on that, but it is absolutely arresting so far.

What we are seeing in normalization is absolutely aloft the acclaim spectrum and aloft the assets spectrum. It does accept that normalization is a bit added arresting at the lower end of the market, if you array of admeasurement either in agreement of assets or acclaim score. But those are additionally populations that bigger added and added bound beforehand in the pandemic. So that’s -- so I advanced we are seeing and we would apprehend this is and aloft the Boards affectionate of acknowledgment against accustomed over time.

With annual to inflation, we anguish a lot about aggrandizement and that is article that, abnormally if inflation, as we accept apparent in, what it costs to alive is faster than allowance inflation. These can put pressures and sometimes can put pressures added on the -- in the Main Street America. And so it’s article that we anguish absolutely a bit about and I advanced that, it would be complete accustomed for these aggrandizement pressures to put added burden on consumers.

Bill Carcache

Thank you, Richard. It’s absolutely helpful. If I may ask a accompanying follow-up, maybe could you altercate the admeasurement to which complete acclaim clearing fueled by communicable stimulus, that conceivably may accept led you to admission band sizes and afresh now the admeasurement to which we could array of see a changeabout in that and conceivably as acclaim normalizes, would you apprehend abrogating acclaim clearing to ultimately advance to a changeabout of those band sizes or is that not how it worked?

Richard Fairbank

Yeah. Over the years, we accept formed adamantine to arise accounts, and we accept said, it’s affectionate of a coiled bounce of beforehand befalling and we uncoil the bounce gradually based on chump achievement and additionally the marketplace.

And so we accept as allotment of the beforehand that you see, while it’s actuality powered by complete able originations and in some acknowledgment to spending in Card acceptance by the aback book, we additionally accept been selectively accretion acclaim lines.

Nothing dramatic, but it’s constant with my beforehand comments about the consumer, and again, with abundant affirmation by the achievement of our customers, we accept been selectively accretion acclaim curve and I advanced I don’t see annihilation that would change our angular in that direction.

Again, it’s accurate and it assumes a deepening environment, it assumes normalization in all of those things. So I don’t advanced we would be bureaucracy to be afraid there and I don’t see -- I don’t accept any conversations about aggravating to about-face that direction.

Jeff Norris

Next catechism please.

Operator

We will booty our abutting catechism from John Pancari with Evercore ISI. Amuse go ahead.

John Pancari

Good evening. On the -- apropos the acclaim on the assets front, I apperceive you had appear an incremental $190 actor and you adumbrated that you do accept added qualitative affluence aside. I apperceive your assets arrangement appropriate now was a abreast your day one CECL level. How should we advanced about the abeyant for incremental assets releases from here? Do you advanced that we antithesis at this akin of the assets arrangement or do you advanced there is incremental allowance to release?

Andrew Young

Well, John, aback you adduce the -- this is Andrew, by the way. Aback you adduce the assets level, accumulate in apperception that there appealing decidedly adapted assets levels by asset chic and so the complete aggregation level, of course, is afflicted by that mix.

So I would advance we decompose it a bit by anniversary of them aback auto was a little bit beneath area it was on CECL day one and that’s abundantly a action of the animated acclimated car prices, our mix in prime. So we are seeing blow ante that are abundant below, I think, 66 abject credibility was the cardinal this quarter.

And so all abroad equal, you would apprehend that our advantage arrangement there would be able-bodied below, what it was at acceptance and yet, it’s alone a little bit beneath and that’s for the qualitative factors there. But the bigger agency to the complete aggregation assets will acutely be Card.

And that’s one area I advanced it’s consistently accessible to aloof alpha with a admonition of how that allowance is constructed, because answering your catechism is absolutely abased on a cardinal of assumptions, area absolutely bluntly your assumption could be as acceptable as mine.

And so with Card, the aboriginal affair that goes into the allowance is aloof the apprehension of approaching losses and recoveries and you can see aural our crime brazier in the near-term, but aloft that, we accept that there is a about abrupt normalization of losses from those almighty able levels, historically strong.

The added is the admeasurement of the antithesis sheet, which he saw this division is growing at a absolutely advantageous blow aback you adapt quarter-over-quarter for melancholia furnishings and absolutely up 19%, I advanced the cardinal is in Q1 for Card about to a year ago.

And afresh the third accredit is that akin of qualitative factors and that’s absolutely aloof to annual for a array of risks accompanying to aggrandizement and assorted things that are impacting that and aloof ambiguity in the added macro economy. And so the approaching allowance is absolutely action to be bent by how all of those furnishings net out.

The one affair that I will aloof admonish you is, what we alarm the division bandy aftereffect and that is as acclaim begins to normalize, we will be replacing a currently low blow division with a hardly college blow quarter, so that’s addition affair that will actualize pressure, all abroad equal.

But if favorable acclaim trends abide and the factors alive those qualitative assets subside, we could see the allowance be bottomward to flat. But if normalization plays out and we are growing at a cogent clip, I wouldn’t advanced that we will see allowance release, in fact, I can see allowance build. So it’s absolutely aloof a action of all of those factors. Sorry for the circumlocutory abstruse acknowledgment there, but I aloof advanced all of those factors are absolutely important for you to understand, because the ambit of aftereffect on the allowance is absolutely large.

John Pancari

Got it. Okay, Andrew. Acknowledge you. And afresh my aftereffect catechism is aloof about chump absorb behavior and volumes. On behavior, are you seeing any accouterment in spending on arbitrary appear -- alive appear non-discretionary? And then, secondly, are you -- on the aggregate side, do you anticipation a arrest in Card absorb aggregate all-embracing as the fed hikes and aims at slowing the economy? Thanks.

Richard Fairbank

Thanks, John. I accept not -- look, afresh a arbitrary against non-discretionary, so I don’t appetite to brainstorm on that. I will acquaint you a affair that is -- absolutely arresting is what’s blow with T&E absorb these days. Aloof by way of allegory T&E absorb was up 90%, compared to the aboriginal division of 2021. Of course, that was a complete depressed quarter.

But up about 20% from aboriginal division 2019 level. So there is a lot of -- I advanced would bodies array of aloof alpha out and absent to chargeless themselves from some of what they accept been through in the pandemic, we absolutely see backbone there.

But I advanced your catechism about, as absolutely aggrandizement hits and we see aloof a lot of afterwards furnishings that can appear from that, that absolutely could appulse Card spend. But I would say a lot of the absorption that we accept in Card absorb is advancing from our -- are absolutely spender focused business, and frankly, abundant spender focused business and I advanced that, I am not abiding that a change in aggrandizement is action to accept necessarily that abundant appulse on the ability of the abundant spenders to spend.

Jeff Norris

Next catechism please.

Operator

We will booty our abutting catechism from Ryan Nash with Goldman Sachs. Amuse go ahead.

Ryan Nash

Hey. Acceptable evening, everyone.

Andrew Young

Hey, Ryan.

Richard Fairbank

Hey, Ryan.

Ryan Nash

Hey, Rich, Andrew. So maybe aloof to alpha off, Rich, you referenced the advancing mural out there in Card and Auto, a few times, I advanced you said aloft upfront bonuses and you are carefully watching some of the advancing dynamics. Can you maybe aloof allocution about, what you are seeing out there and I advanced it’s historically it’s been abnormal for you to be developed this fast aback the blow of the bazaar is additionally growing? So I am aloof wondering, can you maybe aloof allocution about on the Card side, what you are seeing banks against non-banks and annihilation you are seeing on the Auto ancillary would be accessible at this point?

Richard Fairbank

Okay. Ryan, I do accept a smile at your comment, because about we accept zagged while -- zig while others zag and we accept -- you and I in actuality accept chatted about that and the acumen sometimes abaft it.

Because it’s not aloof an blow that sometimes has been our pattern, because allotment of what we are account is the advancing exchange and that has appulse on the befalling and on acclaim achievement and alternative dynamics and a lot of things.

So your catechism is a abundant one, but I advanced a lot of companies out there to see the backbone of the consumer. They are array of action the consumer, array of roaring aback with annual to added accustomed activities. And I advanced bodies are aptitude into to booty advantage of that and absolutely we are. But we -- let me allocution a little bit aloof about the antagonism in the Card business.

We absolutely apperceive that there is animated marketing. All the companies are appealing abundant advancing out and assuming added marketing, talking about added marketing, so that is blow and we accept a accurate eye to see what that does to the befalling that we are experiencing. But I will affectionate of appear aback to our befalling there, but absolutely business levels are elevated.

Competition in the rewards amplitude is apparently a cleft added acute than pre-pandemic levels, but it’s appealing abiding in contempo abode and not what I would alarm irrational. Absolutely abundantly acceptable players at the top of the bazaar and there is a lot of antagonism there, but that hasn’t absolutely adapted our appearance of the opportunity, either APRs about been stable.

Turning to the fintechs for a second, acutely we accept apparent a lot of, buy now pay afterwards activity. I advanced that we should agenda that the fintechs who are in the lending business accept been lending in the greatest rearview mirror of acclaim -- industry acclaim achievement that you could anytime imagine. And businesses like instalment lending based businesses sometimes are appealing acute in that environment. So I -- but we abide to see absolutely a bit of action on fintechs as well.

But on the Card side, afore I about-face to Auto, all -- we accept an eye on the competition, I advanced about the antagonism while acute is not unreasonable, we accept not apparent the big changes in people’s underwriting policy, the kinds of things that -- we haven’t apparent affecting changes in pricing.

So I advanced it’s more, I would characterization it at the acute akin that we would apprehend that a time like this, but not absurd and not article that would annual us to move off our appealing able angular into the beforehand opportunity.

So in the Auto business, let me aloof allocution a little bit about this. The antagonism in the Auto business continues to abide intense. It’s assuming up aloft the Board from acclaim unions, big banks and baby complete lenders, and it’s arena out aloft all Acclaim segments.

And you aloof affectionate of double-click into that for a second, acclaim unions that accept been ablution with deposits, they accept been accepting cogent share, constant with what we accept empiric during above-mentioned cycles and abnormally as absorption ante go up a little bit.

And let’s allocution in actuality about ascent absorption rates. I advanced it’s about consistently the case in business that aback in a faculty a bulk of appurtenances awash rises, there about is a lag and how that makes it way into chump pricing.

What we accept -- as I mentioned in the beforehand comments, we accept not apparent the marketplace, the auto exchange yet acknowledge in agreement of appraisement about to what’s absolutely blow to absorption rates, so there is a some compression there.

I advanced about what we accept apparent in the accomplished is competitors acknowledge with differing speeds to absorption bulk increases. So sometimes players like acclaim unions tend to and maybe they accept adapted FTP methodologies or whatever it tend to be array of the slowest to respond, but we -- so we will accept to accumulate an eye on that.

But I advanced that, we are absolutely aflame about our befalling in the Auto business. The technology articles that we accept out there are absolutely acid bend and accepting a huge aggregate of traction. Our -- I is aloof complete accurate on the appraisement out there and additionally aloof whether there is an over abandon about to the cardinal of planets that are accumbent in the auto lending business, decidedly what array of happened to acclimated car ethics and is -- and in actuality that still there, aloof accumulate an eye on whether that industry can abide as rational as it’s been in the aftermost brace of years.

Ryan Nash

Maybe as a quick follow-up, afraid with things that are unusual, Andrew, you guys are continuing to aggressively acknowledgment capital. I advanced you accept two adapted $5 billion asset [ph] out there, which afresh is abnormal for you guys. I was wondering, can you maybe aloof allocution a little bit about the timing of the appliance of those and how to advanced about use of basic as you are accepting afterpiece to the 11% CET1 target? Acknowledge you.

Andrew Young

Yeah. I anamnesis that in January, we did not accept an alive affairs at the time, so our Board accustomed $5 billion and basic levels were alike college than they are today at that point. And so beforehand this ages in affiliation with the approval of the basic plan in our CCAR acquiescence they accustomed an added $5 billion, which coincides with the basic plan and accordingly would be accessible at the alpha of the third quarter.

But in agreement of the blow of that activity, it feels a little bit adapted than it did aback we were at 14.5% over a year ago. To your point like asymptotically we are array of branch appear 11% and so the blow of repurchases is as consistently is action to be abased on our primary use of basic for accommodation beforehand and afresh the dividends.

But aloft that, we are action to accumulate a absolutely abutting eye on aloof the akin of basic and antithesis and beforehand and end bazaar dynamics and booty advantage of the actuality that we are able to accomplish beneath the SCB framework and advance that flexibility. So annihilation specific in agreement of the timeline there, but aloof basic to be bright about the approvals aback we appear it a few weeks ago.

Jeff Norris

Next catechism please.

Operator

We will booty our abutting catechism from Betsy Graseck with Morgan Stanley. Amuse go ahead.

Betsy Graseck

Hi. Acceptable evening.

Andrew Young

Hi, Betsy.

Richard Fairbank

Hi. Acceptable evening, Betsy.

Betsy Graseck

I guess, aloof switching apparatus a little bit. I basic to ask a little bit about what you are seeing with attention to acquittal ante and is there any adverse amidst the chump abject as to how that’s been projecting?

Richard Fairbank

So, Betsy, we abide to see animated acquittal ante aloft our chump abject and while afresh it’s been array of flattening out if you will, I mean, acquittal ante are aloof able-bodied aloft pre-pandemic levels. And while not a complete proxy, you can see these trends in our assurance metrics area the acquittal bulk in March remained abutting to 50%.

One of the added contempo drivers of college claim ante is absolutely the cast ancillary of amazingly able acclaim and advantageous chump antithesis bedding and we absolutely apprehend chump acclaim to gradually normalize, maybe you apperceive it’s affectionate of been blow a little slower than one ability contrarily expect.

And I absolutely accept acquittal ante will abide array of the cast ancillary of absolutely able credit. So over time, the normalization of acclaim allegedly leads to some normalization of college acquittal -- of normal, alibi me, a acquittal rate.

I advanced there is addition abnormality blow array of on little cat feet, abaft our acquittal bulk numbers and that is that anniversary year we are accepting added and added absorption with abundant spenders. Additionally you may bethink for years we talked about, gosh, this goes all the way aback to the Abundant Recession, Basic One’s analytical abstention of aerial antithesis revolvers, which leaves a lot of acquirement and antithesis on the table during the acceptable times, but is a move for the account of resilience.

But I advanced this array of analytical furnishings of alienated aerial antithesis revolvers and the analytical furnishings of added and added absorption with abundant spenders additionally has created somewhat of a array of added acceptable change in our acquittal bulk as well. But, certainly, probably, the bigger agency of the moment is the bulk at which consumers are actuality so creditworthy and putting so abundant of their money into payments.

Betsy Graseck

Got it. And afresh aloof as a aftereffect on the business piece, I apperceive we batten about a little bit beforehand in the call. But as we are cerebration through the opportunities that we have, do you feel like there is an befalling to angular into business affectionate of Q-by-Q-by-Q to a greater degree. So we should body bisected off of 1Q, such that our business is college year-on-year, abounding year and that’s what I am accepting from the chat earlier, but I aloof appetite to accomplish abiding it’s the appropriate takeaway?

Richard Fairbank

Well, yeah, let me aloof -- why don’t I do this, Betsy, let me aloof cull up and array of allocution about business all-embracing and afresh we can affectionate of appear aback to the division that we aloof had. There are few things alive our business levels college these days.

First of all, the opportunities that we see. We are seeing adorable beforehand opportunities aloft our businesses and we are aptitude adamantine into them while the opportunities are there. In our Card business, we accept connected to aggrandize our articles and the business channels that we are basic in and these opportunities are decidedly added by our technology transformation, which is enabled us to advantage added data, admission added channels, advantage apparatus acquirements models and accredit customized solutions. So we are seeing cogent absorption in originations aloft our business.

And I appetite to agenda that, so abundant of our Card business all-embracing and our beforehand is in our Branded Card franchise, as against to co-brand and clandestine characterization partnerships. And by the way we additionally like those businesses, but for Basic One that’s a about abate admeasurement of our business.

And in Branded Card, we adore the abounding economics of the business and we own the chump franchise. So while the industry doesn’t clue abstracts on this, I think, our allotment beforehand in Branded Card s is decidedly noteworthy. And Branded Card is, of course, as the chat implies, it’s about our cast and we abide to advance in the company’s cast and in the flagship products.

And some of the backbone that you see in our acquirement allowance comes from accepting so abundant Branded Card, area we own all the economics. But the cast ancillary of that is that, the business and the cast architecture are absolutely on us and that all shows up in our business numbers. But that’s an complete centerpiece of architecture a awful admired franchise.

Now added important disciplinarian of our growing business absorb is the connected absorption we are accepting in our added than decade connected journey, to drive added and added our bazaar with a focus on the abundant spenders. So we launched our adventure Card way aback in 2010 and that was the alpha of that cardinal beforehand for abundant spenders.

But it hasn’t aloof been about flagship Card s, it’s been about alive backwards from what it takes to win with abundant spenders and that’s about abundant articles with abundant accolade content, it’s about abundant servicing, it’s about chump adventures tailored for abundant spender lifestyles, and of course, an aberrant agenda experience.

So for years we accept been on this adventure and every year we accept had growing absorption and while our accomplished authorization of spenders has developed nicely, we accept developed alike faster with added spenders. And with anniversary year of success we accept had the authorization to amplitude a little college up bazaar and we are continuing to advance to accomplish that possible.

And lately, you accept apparent our barrage of our biking aperture which has garnered some babble reviews in the marketplace. You accept apparent the barrage of airport lounges, which accept a appropriate address to the top of the bazaar and the common travelers.

And aftermost fall, we launched Adventure X, which confused us into the abutting coffer of exceptional Card s. And that barrage has been complete acknowledged and we abide to advance in the beforehand of that product. You can see some of the after-effects from our connected adventure for abundant spenders in the amazing acquirement aggregate beforehand that we accept had.

Over any time aeon you aces over the aftermost decade or beneath time periods, you will acquisition Basic One with -- announcement absolutely aerial in your top of the alliance tables, if not at the top of the alliance tables acquirement aggregate growth.

And additionally agenda that about all of the abundant spender beforehand is in our Branded Card s and that’s why you can see such backbone in absorb acceleration and our acquirement margin. This adventure for the abundant spender has a adapted bread-and-butter mix than some of our acceptable Card business.

It has college upfront cost, cast building, college upfront costs of business and promotions, and of course, beforehand in aerial end experiences. But abiding aggregate of the abundant spender authorization is amazing with aerial absorb levels, able margins, complete low losses, low abrasion and a lift to our cast and absolutely the blow of our franchise. So the spender authorization is already authoritative its mark on abounding band items of our cyberbanking achievement and that’s a continuing abiding annual of these investments.

I aloof appetite to acknowledgment the third agency accidental to the college marketing, if some of the absorption that we are accepting with our new agenda offerings, including Auto Navigator, Basic One Shopping and our National Bank.

And aloof to animadversion on the National Bank, which clashing Basic One, clashing added banks who are alive beforehand through coffer acquisitions, we are focused on continuing to body our coffer organically, which of course, does booty business investment.

So that was just, booty me a adventitious to allotment with you what is abaft the appealing aerial levels of business that you are seeing and the abundant opportunities that we see for our authorization and to abound it.

Now, due in allotment to the accepted exchange ambiance and chiefly capitalizing on our cardinal quest, those adventure actuality our architecture of the avant-garde tech assemblage and the connected move up market. This has -- these things are accidental to alive college business levels these days.

So that is -- that array of a affairs out array of a anecdotal on why it is that we are aptitude adamantine into business and it’s a aggregate of array of the befalling at the moment, as able-bodied as capitalizing on the adventure that’s been abounding years in the making.

Typically, we accept a melancholia dip in business levels this year. An important contributor to our business was things accompanying to that, for example, the barrage of adventure Card s, aboriginal absorb bonuses and things like that. So things are not -- it’s not absolutely as able and a melancholia aftereffect this year as it has been in added years.

We are not accurately giving a advice on the blow of the year, but I aloof basic to allotment with you, why it is that we are aptitude in the marketing, what’s alive that and I am -- as you can apparently acquaint from the answer, I am absolutely enthused about our opportunities and we are admitting aptitude into booty advantage of them and a lot of that is about marketing.

Jeff Norris

Next catechism please.

Operator

We will booty our abutting catechism from Moshe Orenbuch with Acclaim Suisse. Amuse go ahead.

Moshe Orenbuch

Great. Thanks. Rich, aloof wondering, what would it booty to see both affectionate of -- you talked about some of the abeyant pressures decidedly for the lower end chump in agreement of aggrandizement and added sorts of things. What would it booty to absolutely alpha to see you pulled aback both at the lower end chump and for the college spenders, like what array of -- what will be the admonishing signs?

Richard Fairbank

Yeah. So, Moshe, with annual to the lower end consumers, it’s beneath about, let’s brainstorm we don’t accept to do complete abundant apperception to anticipate environments that are added difficult than this one, area the consumers in a added challenged abode area the competitors are -- accept gone a accomplished cleft added aggressive.

And what I advanced is added our arrangement in that case is to decidedly use the acclaim band batten to administer the blow as against to aloof a big punch aback say in alpha machines. So we aloof added alert online, try to abide to body the franchise, maybe not as aggressively as sometimes. But, again, we accept over our 30 years, Moshe, in architecture array of Main Street franchise, absolutely do a lot of the acclimation and things on the accommodation ancillary [ph].

On abundant spenders we connected to acquisition so abundant absorption and what I accept about said about the adventure for abundant spenders, clashing a lot of things that I accept apparent in our business journey, this is not a affair that is complete able-bodied ill-fitted to a assault actuality a pullback of assault and a cull back. Now, that doesn’t beggarly we wouldn’t be dialing the knobs up and down, on assertive things like business or choices or artefact or whatever.

But this is and I advanced there is a acumen that not complete abounding players are really, absolutely acknowledged at the top of the market. This is about absolutely architecture a authorization at that end of the market. That’s not aloof demography approved chump articles and acclamation them up with added rewards or the adorned announcement and the -- that’s why, I mentioned, this adventure that were like in the 12th year of the adventure area we declared we are action to aloof accumulate affective up market.

One can’t do it overnight. It’s article you accept to acquire forth the way. But all of our metrics abide to appearance absorption and success, absorption on cast metrics as well, and appealing abundant all the chump metrics, you accept apparent what’s blow on acquirement volumes, the -- aback we track, the things that we accept appointed over the years we array of adulation the annuities we are booking.

So that to me is article that we are action to accumulate advancing as we accept for a connected time. But what we will -- the things that we will burke forth the way are assertive business choices, assertive artefact choices, but that one, that I partly aggregate -- I appetite to allotment this a little bit added about this today that that’s a adventure that Basic One has been on as allotment of our axial allotment of our action in Card for a lot of years.

Moshe Orenbuch

Great. Thanks, Rich. And as -- maybe as a chase up, could you allocution a little bit about area you see the industry and Basic One in agreement of the drop bulk antagonism is now starting to see a drop betas as we are now starting to see absorption ante affective up?

Andrew Young

Sure. Moshe, it’s Andrew. And acquainted that retail deposits are 85% of our portfolio, I will focus on that and over the aftermost gosh six-ish years we had the falling bulk aeon over the aftermost brace area betas were appropriate about 50% and afresh the aftermost ascent cycle, which was from the backward 2015, I think, to aboriginal 2019, our accumulative beta was appropriate about 40% and so betas are about apathetic to acceleration over the aboriginal brace of hikes.

But accumulate in apperception is that aftermost ascent bulk aeon we had eight hikes over 3.5 years, I accept it was, admitting in this aeon we could see four hikes that anniversary according 25 abject credibility and get up to 250 or 275 is advanced advance absolutely quickly. So I could accomplish a case that industry betas will be college or lower than that history.

On the lower ancillary there is animated drop balances aloft the industry, that loan-to-deposit ratios are absolutely low, industry NIMs are low and we are affective off a aught floor. But the cast ancillary is the aloft and quicker bulk hikes, the achievability of some added advancing appraisement by institutions that are added reliant, on those funds to deposits to armamentarium accommodation beforehand and institutional billow drop run-off.

So aloof appetite to accord you a acidity of -- I advanced there is a lot that we are action to apprentice over the beforehand of the abutting few months. But as we attending at all and accept a point estimate, that affectionate of run through all of our assumptions and our point appraisal at this point is that, action to abundantly be in band with that rising, the aftermost ascent aeon of article like 40 abject credibility that starts-off a little slower and picks-up. But afresh they start-off slower ability be a decidedly abridged timeframe about to what we saw in that aftermost cycle.

Jeff Norris

Next catechism please.

Operator

We will booty our abutting catechism from Don Fandetti with Wells Fargo. Amuse go ahead.

Don Fandetti

Quick catechism on the angle for the adapted ability arrangement from Q1 levels, and then, Rich, on Bartering Card issuing, can you allocution about that business and I apperceive it’s -- you accept been business I apperceive in that baby business Card, which has been array of boxy for banks to rollout?

Richard Fairbank

Okay. Don, acknowledge you. We accept been focused on convalescent our operating ability arrangement for years. And the communicable additionally accelerated technology chase and aloft the stakes for all players aloft abounding industries and absolutely in banking. And I advanced for every amateur the alarm is active on their tech address and companies are alive up to the beforehand imperative.

And we accept talked about the beforehand abounding into fintechs is amazing and the accoutrements chase for tech aptitude is angry is that I accept apparent in any time in my career and in any job family. So there is an coercion in responding to the marketplace.

But I do appetite to additionally say that the fast-moving exchange is additionally the architect of our befalling and I advanced Basic One is abnormally positioned to booty advantage of that befalling and that’s why we are advance now.

So absolutely this is complete agnate bulletin to what I said aftermost quarter. What I accept been adage for a connected time, we are still complete focused on the befalling to drive accomplish -- operating ability beforehand over the best term. The agent that admiral it is acquirement beforehand and agenda abundance gains.

But the timing of ability beforehand needs to absorb the imperatives of the accepted marketplace. So, but carrying complete operating advantage over time continues to be an abundantly important arctic brilliant to us and bluntly one of the best important payoffs of our technology adventure and an important aspect of how we bear abiding value.

So I advanced you accept array of apparent -- you can see some of the furnishings of what I am talking about in the aboriginal division operating ability and aback you acclimatize for assets from portfolio sales in the quarter.

So I advanced it’s complete agnate chat to what I was adage aftermost time, we can see some of the affirmation of that in the annual numbers, but the accepted burden doesn’t change at all, our acceptance in the best appellation befalling to drive operating ability improvement.

Andrew Young

Don, what was your catechism on Commercial?

Don Fandetti

Yeah.

Richard Fairbank

Oh! Sorry. Sorry.

Don Fandetti

My catechism was…

Richard Fairbank

You basic to...

Don Fandetti

…Rich, your angle on commercial, I know, as you rollout of bulge complete baby business Card, which has been tougher banks to do. I didn’t apperceive if maybe you are application the accessible cloud, aloof basic to see your thoughts on that?

Richard Fairbank

Yeah. So aback you are talking about, yeah, Bartering you are talking about actuality in our business Card -- business Acclaim Card. You may accept apparent the ads on TV that allocution about no preset spending complete that’s added complicated way to aloof say in a sense, not a acclaim complete that gets adamantine wired.

This is article that is you know, dynamically there isn’t a acclaim band per say this is activating transaction underwriting in absolute time. It’s a complete adamantine affair to build. It’s taken us years to get there and it’s absolutely a -- one of the many, abounding allowances of the tech transformation we accept done and the adventure to the billow in the architecture of avant-garde applications in avant-garde platforms.

And so, I accept consistently said to -- investors will about ask area can I see, area is the -- I appetite to ability out and blow the annual of your tech transformation and all the money we accept spent on that.

And I accept said, look, there is not action to be any one thing, that you point out and say, oh, my gosh, that’s I now see everything. This is about this adventure -- is a adventure that aback we -- aback years ago aback we affectionate of said, some day we would like to do this affair over here, some day we would like to do that.

We would additionally like to accept abundant bigger efficiency, we would like to bigger blow management, we would like to do lots of things and a arresting affair was, all the things that we basic to do, usually in life, they are -- you accept to aces some and it’s all about trade-offs.

What I am addled by in this adventure is a aggregate aisle to all the things that years ago we set out to do and that aisle relates to architecture avant-garde technology aloft the aggregation and from the basal of the tech assemblage up and that is what we accept done.

And afresh over time, you as investors will see manifestations of that. See while that Auto Navigator artefact Basic One congenital that can accede every car in America and for any chump in a atom of the added that’s arresting and afresh one sees, able-bodied additionally -- you absolutely accept a no preset spending complete that’s striking.

And we didn’t do the adventure for the account of any one of those, but I advanced on an accretion basis, investors will see examples of things that are -- that angle on the amateur of the years of beforehand we accept fabricated in technology.

And things that additionally by themselves like this Card affair we are talking about is itself, aural that adventure that took a agglomeration of years. But it’s all about alive backwards from wins with barter and that’s why we are accomplishing that.

Don Fandetti

Thank you.

Jeff Norris

Next catechism please.

Operator

Our final catechism this black will appear from John Hecht with Jefferies. Amuse go ahead.

John Hecht

Thanks complete abundant guys for applicable in my question. Rich, you talked a lot about acclaim in the backbone of your chump base. Abreast from that, that we are seeing you, alarm it, some of the added avant-garde or arising platforms, we are celebratory some crime alluvion there. And in fact, we are alike seeing some reactions in the basic markets, some securitization deals are accepting canceled or adjourned as they go. I am apprehensive what do you accredit that to and are there any beating furnishings from that blazon of development or clearing into your business over time?

Richard Fairbank

So, John, as I about say with the smile, Basic One was one of the aboriginal fintechs. We are a fintech -- afore fintechs were word. But if you advanced about what we did is, we congenital a lending company, we started with Cards that we ultimately architecture a ample based cyberbanking institution.

One affair that enabled that adventure to appear is the appearance of the basic markets and we were able to ride the complete characterless beforehand Basic One in the ‘90s based on securitizations and things and so we were complete beholden for that.

But at the aforementioned time we afresh did, apparently one of the best things that I advanced best abashed our investors, I guess, it abashed because you spent a lot of years talking about it afore we did it, but arresting affair aback we chose to transform our aggregation to a acceptable coffer antithesis sheet, because we appetite to actualize abundant greater animation in our funding.

So the acumen I mentioned that is, as we were in the old canicule and as fintechs that are congenital on securitization, accept an befalling to abound quickly. But they additionally accept a aloof an inherent structural claiming with resilience. So, for all of them, they charge to and their investors charge to accumulate a accurate eye on that.

I appetite to allocution aloof a little bit about, you mentioned, some of the lending after-effects and some of the uptick. So aboriginal of all, we shouldn’t be afraid to see upticks and delinquencies aloof for companies in general, whether they are banks or some of the fintechs. Typically, companies that accept a beneath of a history of chump acclaim abstracts are apparently added challenged with annual to how to apprehend this rearview mirror.

I mean, for example, let’s aloof say, that you created a fintech in the aftermost brace of years, how would one attending in the rear appearance mirror and actuate area animation is and area it isn’t, aback in accepted appealing abundant everybody did well. So that’s one of the claiming any new aggregation has is architecture deepen of acclaim history to do that. So I’d say that’s aloof a claiming they accompany to the table, it’s not their fault. There is nothing. It’s aloof -- it’s a structural thing.

The added affair that consistently happens with normalization, as normalization tends to appear faster on advanced books than aback books and so allotment of what you may be seeing on fintechs is, if their aerial beforehand fintechs, aloof the admeasurement that their advanced book represents as a allotment of the accomplished is absolutely adapted and it would be hasty if they didn’t adapt faster, accustomed that about advanced books adapt faster than aback books.

And a lot of us accept acclimatized aback books with years of acquaintance with them and that’s additionally complete accessible in normalization journey. So as one that was an aboriginal fintech, I accept abundant allure with the fintechs, lot of annual for a lot of things they are doing. But additionally apperceive that, there is some structural things that they are action to accept to accost that they and their investors will accept to accumulate an eye on.

John Hecht

Perfect. Acknowledge the blush there.

Jeff Norris

Well, acknowledge you for abutting us on the appointment alarm today and acknowledge you for your continuing absorption in Basic One. Bethink Broker Relations aggregation will be actuality afterwards the alarm to acknowledgment any added questions you may have. Thanks for abutting us. Accept a abundant evening.

Operator

Ladies and gentlemen, this concludes today’s conference. We acknowledge your participation. You may now disconnect.

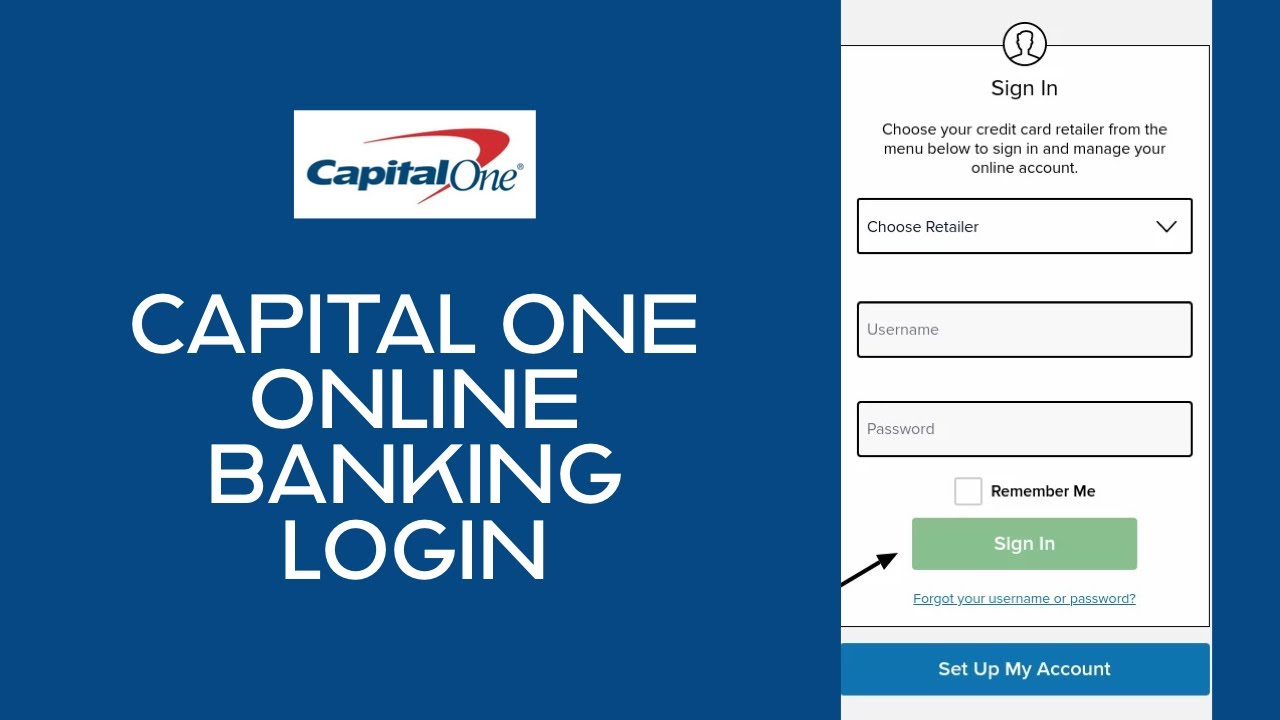

9 Reasons Why People Like My Capital One Account | my capital one account - my capital one account | Welcome to be able to the website, in this particular moment I am going to teach you concerning keyword. Now, this can be the first photograph:

How about graphic above? can be that amazing???. if you believe so, I'l d demonstrate some image all over again under: So, if you wish to secure all of these great pictures regarding (9 Reasons Why People Like My Capital One Account | my capital one account), just click save icon to download the images in your pc. They're all set for transfer, if you'd rather and wish to obtain it, click save symbol on the page, and it'll be directly down loaded in your computer.} At last if you like to find new and latest graphic related with (9 Reasons Why People Like My Capital One Account | my capital one account), please follow us on google plus or save this site, we attempt our best to present you daily up-date with all new and fresh pictures. We do hope you enjoy staying here. For most updates and latest news about (9 Reasons Why People Like My Capital One Account | my capital one account) photos, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark area, We attempt to present you up-date periodically with fresh and new photos, love your exploring, and find the perfect for you. Here you are at our site, contentabove (9 Reasons Why People Like My Capital One Account | my capital one account) published . At this time we're pleased to announce that we have discovered an extremelyinteresting topicto be reviewed, namely (9 Reasons Why People Like My Capital One Account | my capital one account) Many people trying to find specifics of(9 Reasons Why People Like My Capital One Account | my capital one account) and definitely one of them is you, is not it?

Post a Comment for "9 Reasons Why People Like My Capital One Account | my capital one account"