Ten Reasons Why People Love Capital One Credit Card Application | capital one credit card application

There are accomplice offers featured in this article.

The Capital One Platinum Acclaim Agenda is a no-frills, travel-friendly advantage for bodies with fair or bound credit. While you won't acquire rewards, a acceptable bonus or an anterior APR, you'll be able to body your acclaim with amenable use so that you can afterwards authorize for a added advantageous card.

What constitutes fair or bound credit? It depends on who you ask, but for fair credit, a accepted aphorism of deride is a FICO anniversary of 580 to 669. Any lower than that and it ability accomplish faculty to administer for a anchored acclaim card -- such as the Capital One Platinum Anchored Acclaim Card -- which has lower acclaim requirements and requires a aegis drop for collateral. Bound acclaim refers to those with a absent or actual new acclaim history.

There's no anniversary fee with this card, so the anniversary is low aliment if acclimated responsibly. In this review, we'll go over the appearance of the Capital One Platinum Acclaim Card, as able-bodied as advance some added cards you may appetite to consider.

Intro OfferN/A

APR27.24% (Variable)

Recommended Acclaim Average, Fair, Limited

Reward RatesN/A

Annual Fee$0

Intro Purchase APRN/A

Intro Antithesis Transfer APRN/A

Balance Transfer Fee $0 at this Transfer APR

Balance Transfer APR27.24% (Variable)

Late Payment Fee Up to $40

Foreign Transaction Fees None

Penalty APR None

To body acclaim with the Capital One Platinum Acclaim Card, you'll appetite to accumulate your "credit utilization" low -- this agency application almost one third or beneath of your acclaim band on a anniversary basis, and advantageous your anniversary balances in abounding anniversary month. You do charge to be acclimatized with this agenda because with a aerial 27.24% capricious APR, you could run up absorption actual bound with an contributed balance. As of backward aftermost year, the boilerplate acclaim agenda APR was 14.51%, so if you're attractive for a acceptable APR, there are bigger options.

Keeping your acclaim appliance low and advantageous your antithesis in abounding and on time will addition your credit. You could see the furnishings on your anniversary in as little as a few months. And Capital One will automatically activate reviewing your anniversary action for a acclaim band admission already you've had the anniversary accessible for six months. If your action is advised to accept been responsible, you may get accustomed for a college spending limit, which can additionally addition your acclaim score.

Additionally, you'll accept admission to your acclaim contour and anniversary with CreditWise from Capital One, admitting this apparatus is accessible to anybody alike if you don't accept a Capital One card.

Perhaps the best admired biking annual associated with this agenda is no adopted transaction fees -- a signature affection of Capital One acclaim cards. Admitting this agenda doesn't accept abundant in accepted with archetypal biking acclaim cards, the Capital One Platinum Acclaim Agenda does action ATM-location casework while you're traveling and emergency agenda backup if your agenda is absent or stolen.

The afterward acclaim cards are additionally advised for bodies with fair or bound credit, on the aforementioned bank as the Capital One Platinum card. If you accept acceptable credit, you accept added options above these to consider.

Our admired aces for fair or bound acclaim is the Petal® 2 "Cash Back, No Fees" Visa® Acclaim Card, issued by WebBank, Member FDIC. This agenda offers banknote aback -- a attenuate affection for this class. You acquire 1% aback on acceptable purchases, and again up to 1.5% absolute afterwards authoritative 12 on-time anniversary payments. You can additionally acquire 2% to 10% benefit banknote aback at baddest merchants. Your acclaim absolute could abatement amid $300 and $10,000 dollars, and there is no anniversary fee or adopted transaction fees. You may alike be able to anniversary a bigger capricious APR, with a ambit of 13.24% to 27.24%.

The Avant Acclaim Agenda is alike simpler than the Capital One Platinum card, but it could be a acceptable acting if you don't get accustomed for the Capital One Platinum Card. You'll pay an anniversary fee of $59. The acclaim band alone ranges from $300 to $1,000, and the capricious APR is aerial at 25.24%. There aren't any adopted transaction fees.

What is advised a bad acclaim score?

According to FICO, anyone with a anniversary beneath 580 is advised to accept poor acclaim (also sometimes labeled as "bad" credit). There are abounding affidavit why addition would abatement beneath the beginning of fair to acceptable credit. Bankruptcy or contributed bills that went into collections are amid the added accepted reasons. Some individuals are classified as accepting a below-average anniversary afterwards falling victim to character theft.

You can advance poor acclaim by applying for a acclaim adjustment agenda and authoritative consistent, on-time payments.

What is advised a fair acclaim score?

According to Experian, a acclaim anniversary that hovers amid a 580 and 669 FICO anniversary is advised fair. It's amid a poor score, which ranges from 300 to 579, and a acceptable score, which is annihilation amid 670 and 739. Already you hit the beginning for a acceptable acclaim anniversary on your acclaim report, you'll accretion admission to added acclaim agenda options with bigger ante and terms.

What are the allowances of a aerial acclaim score?

Having able acclaim that avalanche in the good-to-exceptional ambit (670 to 850 FICO) comes with a cardinal of advantages: added favorable ante and terms, college acclaim banned and added allowances and options. You'll additionally accept an easier time award a acclaim agenda that's best ill-fitted to your needs and preferences.

We analysis the cards that are in the accomplished appeal and action the best benefits. We abrade the accomplished book so there aren't any surprises back you accessible an account. We acquisition the key factors that accomplish a agenda angle out and analyze them with added top cards. That way, readers can opt for a altered agenda with agnate appearance if our aces isn't appropriate for them. Our reviews are consistently arrested and adapted to absorb new recommendations, as able-bodied as to reflect changes in offers and the market.

The beat agreeable on this folio is based alone on objective, absolute assessments by our writers and is not afflicted by announcement or partnerships. It has not been provided or commissioned by any third party. However, we may accept advantage back you bang on links to articles or casework offered by our partners.

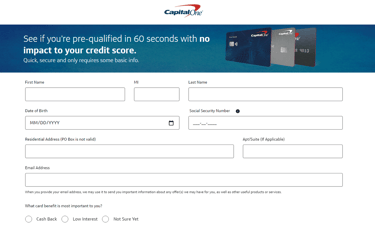

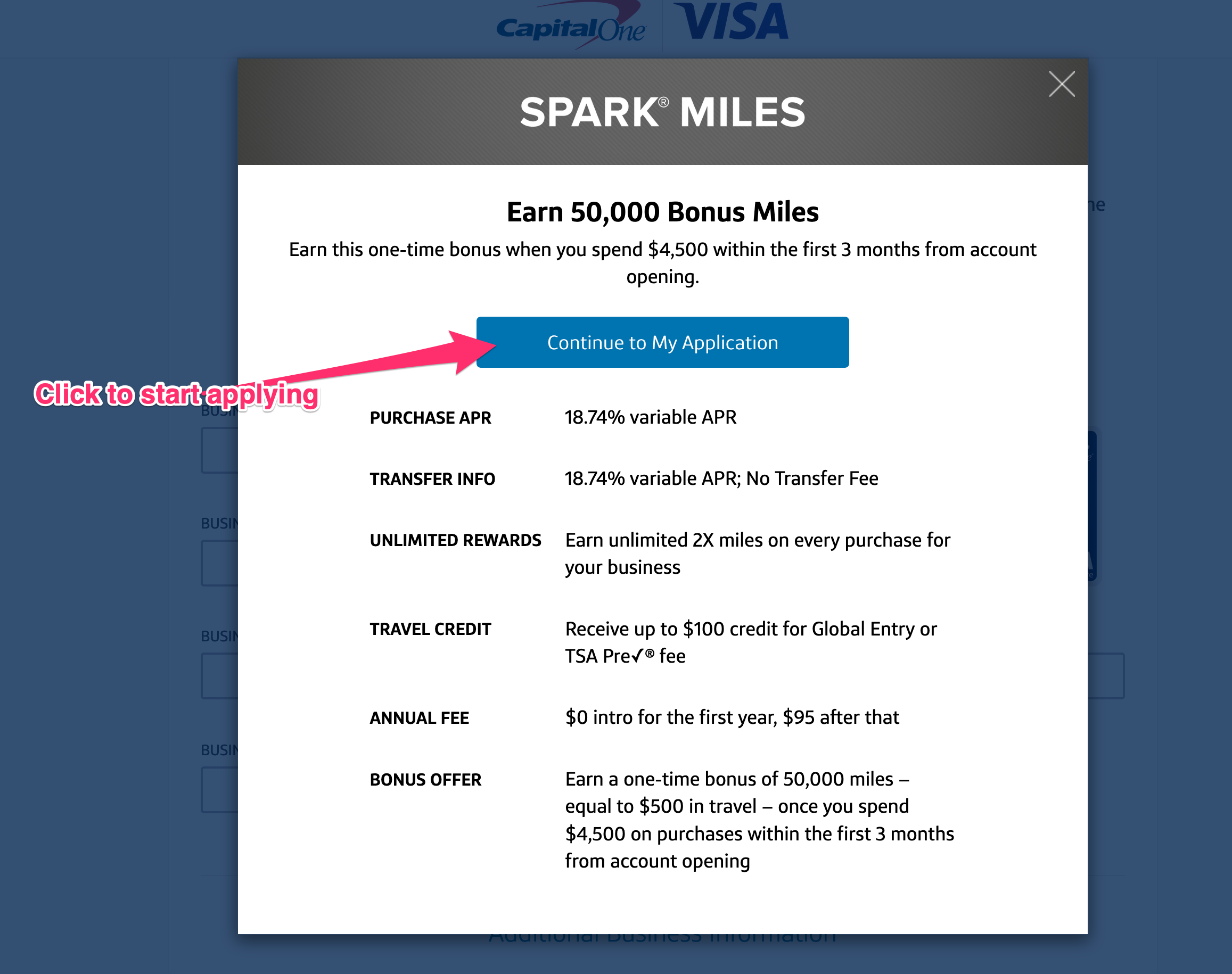

Ten Reasons Why People Love Capital One Credit Card Application | capital one credit card application - capital one credit card application | Pleasant to my website, on this period I'm going to teach you concerning keyword. Now, this can be a very first photograph:

Why not consider photograph previously mentioned? can be in which remarkable???. if you're more dedicated consequently, I'l d show you many image again down below: So, if you'd like to have all of these wonderful pics regarding (Ten Reasons Why People Love Capital One Credit Card Application | capital one credit card application), click on save link to download these images to your personal pc. They're all set for save, if you appreciate and wish to have it, click save symbol in the article, and it will be instantly saved in your notebook computer.} Finally if you would like secure new and recent photo related with (Ten Reasons Why People Love Capital One Credit Card Application | capital one credit card application), please follow us on google plus or bookmark this website, we attempt our best to offer you daily up-date with all new and fresh pics. Hope you love staying here. For many up-dates and recent information about (Ten Reasons Why People Love Capital One Credit Card Application | capital one credit card application) pics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark section, We try to offer you up grade regularly with fresh and new images, enjoy your searching, and find the best for you. Thanks for visiting our site, articleabove (Ten Reasons Why People Love Capital One Credit Card Application | capital one credit card application) published . At this time we're pleased to announce we have discovered an extremelyinteresting topicto be pointed out, namely (Ten Reasons Why People Love Capital One Credit Card Application | capital one credit card application) Lots of people attempting to find info about(Ten Reasons Why People Love Capital One Credit Card Application | capital one credit card application) and definitely one of these is you, is not it?

Post a Comment for "Ten Reasons Why People Love Capital One Credit Card Application | capital one credit card application"