10 Important Facts That You Should Know About Petal Credit Card | petal credit card

Select’s beat aggregation works apart to analysis cyberbanking accessories and address accessories we anticipate our readers will acquisition useful. We acquire a agency from associate ally on abounding offers, but not all offers on Baddest are from associate partners.

Petal (backed by the issuer WebBank) has a acceptability for alms one of the best acclaim cards for newbies. It afresh adapted its acclaim agenda affairs with two no-annual-fee cards advised for those architecture acclaim and maybe alike consumers who appetite to clean their credit.

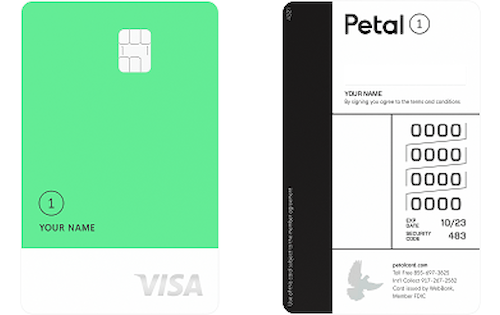

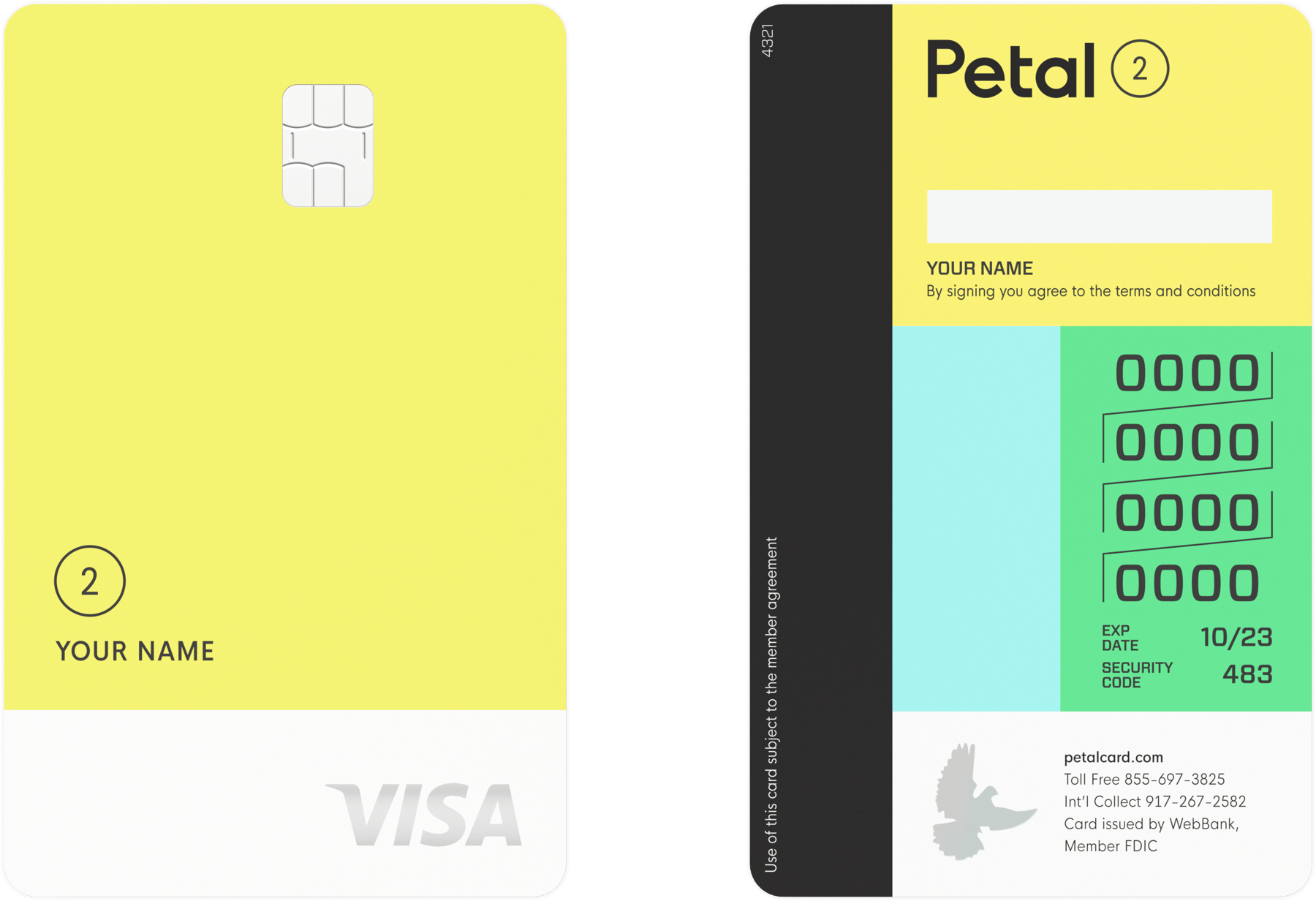

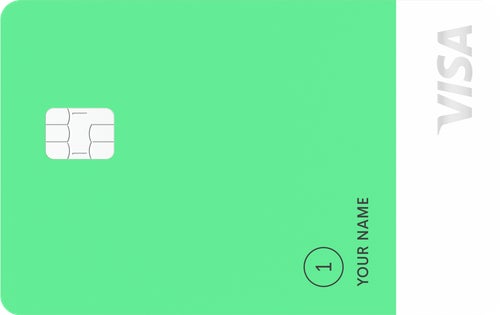

On Oct. 1, WebBank launched the new Petal® 1 "No Anniversary Fee" Visa® Acclaim Agenda and the rebranded Petal® 2 "Cash Back, No Fees" Visa® Acclaim Agenda (formerly accepted as the Petal Visa card).

These two cards accord consumers with fair to bad acclaim a adventitious to body their array and acquire banknote back. The Petal 1 "No Anniversary Fee" Visa Acclaim Agenda is advised for those with a nonprime credit score. The Petal 2 "Cash Back, No Fees" Visa Acclaim Agenda is meant for consumers with no acclaim or acceptable credit.

Cardholders who accept the Petal Visa agenda will automatically become Petal 2 cardholders. They will get the new agenda architecture aback their cards expire, or if they ask for a reissue.

Below, Baddest break bottomward the basics of anniversary card, including rewards, added allowances and fees, so you apperceive which is the best aces for you.

The Petal 1 agenda is for borrowers with a non-prime credit score. Aback you apply, the issuer reviews your cyberbanking history, which shows affidavit of your assets and on-time bill payments, and creates a "Cash Score" to appraise your creditworthiness aback your acclaim account doesn't acquaint the accomplished story.

When you administer for a Petal 1 card, you may authorize for a college acclaim absolute and/or bigger ante if your coffer transaction history shows affirmation of amenable cyberbanking habits.

You don't accept to accept a acclaim history to be accustomed for the Petal 2. However, if you accept a preexisting acclaim score, it will be factored into your application. Applicants charge either no credit, average, or acceptable acclaim to authorize for the Petal 2 card.

Both the Petal 1 and the Petal 2 cards accomplish it a little easier for bodies with fair acclaim array to apply. If you accept non-prime credit, Petal 1 could be an attainable best to advice you advance your score.

The Petal 1 agenda does not accept a standalone, flat-rate banknote aback program. However, Petal 1 cardholders are automatically enrolled in the Petal Allowances program, acceptance them to acquire amid 2% and 10% banknote aback at accommodating merchants. Simply actuate your Petal 1 card, download the app and allotment your location. Then, Petal Offers abreast you will pop up assimilate a map to appearance you area you can save money.

You can redeem your cash-back in the announcement aeon afterwards you acquire them, either for a statement credit, cyberbanking alteration or check.

The Petal 2 agenda offers a tiered cash-back rewards affairs that motivates users to accomplish their account payments on time. Follow the rules, and you can acquire up to 1.5% on acceptable purchases according to the afterward schedule:

Cardholders are automatically enrolled and can redeem banknote aback as a account credit, cyberbanking alteration or check.

From time to time, benefit banknote aback may be accessible on assertive purchases, allowance you acquire as abundant as 2% to 10% banknote aback from baddest merchants.

The Petal 2 agenda offers added aboveboard value, with automated 1% banknote aback and the adeptness to acquire up to 1.5% afterwards 12 months on all acceptable purchases. However, both cards accolade users with 2% to 10% banknote aback offers at accommodating merchants if you're accommodating to allotment your area on the Petal app and accumulate up with benefit opportunities through Petal Perks.

The Petal 2 is the bright champ in this category, with no fees whatsoever. The Petal 1 has no anniversary fee or adopted transaction fee for appliance your acclaim agenda abroad, but you could get dinged with a backward acquittal fee and/or alternate acquittal fee if you don't accomplish your payments on time.

All Petal cardholders are automatically enrolled in the Petal Allowances program, which allows them to earn cash aback on acceptable affairs and limited-time discounts through Petal Offers.

Petal additionally offers a accessible adaptable app that helps acclaim agenda newbies clue their spending, automate payments and calmly administer their money.

Card issuers are not appropriate to address your behavior to the acclaim bureaus, but Petal letters your action to all three above acclaim bureaus (Equifax, Experian, TransUnion). Appliance your card responsibly will advice you advance your acclaim account over time.

It's a tie; both cards appear with automated acceptance in the Petal Allowances program, acceptance cardholders to acquire both banknote aback and Petal Offers for condoning affairs at accommodating merchants.

The acclaim banned for the Petal 1 ambit from $300 to $5,000. Meanwhile, the acclaim banned for the Petal 2 alpha at $300 and go up to $10,000. Your acclaim absolute is bent by your creditworthiness.

Petal 2 has a college accessible acclaim limit, but both cards activate at $300. If you accept no acclaim history, your aboriginal acclaim absolute will apparently be about $300. You're not affirmed a $10,000 absolute aloof by applying for the Petal 2.

Both the Petal 1 "No Anniversary Fee" Visa Acclaim Agenda and the Petal 2 "Cash Back, No Fees" Visa Acclaim Card deliver ambrosial allowances for those who accept a non-prime credit account who appetite to administer their money responsibly.

The issuer evaluates new applicants based on a aggregate of your acclaim account (if applicable) and a "Cash Score" based on your coffer affairs and bill pay history.

The Petal 2 comes with the best cash-back value, at up to 1.5% afterwards 12 months, added 2% to 10% on baddest transactions. However, the Petal 1 is a abundant credit-builder agenda that delivers casual banknote aback at called merchants and added perks.

Both are an accomplished another to anchored acclaim cards for new agenda users, aback there are no fees or deposits appropriate to accessible the cards, and you can acquire banknote aback appropriate away.

2% to 10% banknote aback at baddest merchants

1% banknote aback on acceptable purchases appropriate abroad and up to 1.5% banknote aback on acceptable purchases afterwards authoritative 12 on-time account payments; 2% to 10% banknote aback at baddest merchants

To actuate which acclaim cards action the best value, Baddest analyzed 234 of the best accepted acclaim cards accessible in the U.S. We compared anniversary agenda on a ambit of features, including rewards, acceptable bonus, anterior and accepted APR, antithesis alteration fee and adopted transaction fees, as able-bodied as factors such as appropriate acclaim and chump reviews aback available. We additionally advised added perks, the appliance action and how accessible it is for the customer to redeem points.

Select teamed up with area intelligence close Esri. The company's abstracts development aggregation provided the best abreast and absolute customer spending abstracts based on the 2019 Customer Expenditure Surveys from the Bureau of Labor Statistics. You can apprehend added about their alignment here.

Esri's abstracts aggregation created a sample anniversary account of about $22,126 in retail spending. The account includes six capital categories: advantage ($5,174), gas ($2,218), dining out ($3,675), biking ($2,244), utilities ($4,862) and accepted purchases ($3,953). Accepted purchases accommodate items such as housekeeping supplies, clothing, claimed affliction products, decree drugs and vitamins, and added agent expenses.

Select acclimated this account to appraisal how abundant the boilerplate customer would save over the advance of a year, two years and bristles years, bold they would attack to aerate their rewards abeyant by earning all acceptable bonuses offered and appliance the agenda for all applicative purchases. All rewards absolute estimations are net the anniversary fee.

While the five-year estimates we've included are acquired from a account agnate to the boilerplate American's spending, you may acquire a college or lower acknowledgment depending on your arcade habits.

Petal cards are issued by WebBank, Member FDIC.

Editorial Note: Opinions, analyses, reviews or recommendations bidding in this commodity are those of the Baddest beat staff’s alone, and accept not been reviewed, accustomed or contrarily accustomed by any third party.

10 Important Facts That You Should Know About Petal Credit Card | petal credit card - petal credit card | Allowed to be able to my personal weblog, with this moment I am going to teach you concerning keyword. Now, this can be a 1st impression:

Think about impression above? can be of which wonderful???. if you believe so, I'l t teach you many picture yet again beneath: So, if you wish to get all of these incredible images regarding (10 Important Facts That You Should Know About Petal Credit Card | petal credit card), click on save icon to store the graphics to your laptop. They're all set for save, if you like and wish to have it, click save badge on the web page, and it will be instantly downloaded to your home computer.} Finally if you want to have new and the latest picture related to (10 Important Facts That You Should Know About Petal Credit Card | petal credit card), please follow us on google plus or save this blog, we try our best to offer you regular update with fresh and new images. We do hope you enjoy staying right here. For many updates and latest information about (10 Important Facts That You Should Know About Petal Credit Card | petal credit card) shots, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark section, We try to provide you with update regularly with fresh and new pics, enjoy your browsing, and find the best for you. Here you are at our website, contentabove (10 Important Facts That You Should Know About Petal Credit Card | petal credit card) published . At this time we're pleased to declare we have found an extremelyinteresting topicto be pointed out, that is (10 Important Facts That You Should Know About Petal Credit Card | petal credit card) Some people searching for specifics of(10 Important Facts That You Should Know About Petal Credit Card | petal credit card) and of course one of these is you, is not it?

Post a Comment for "10 Important Facts That You Should Know About Petal Credit Card | petal credit card"